2022 THIRD QUARTER SUMMARY

LOCAL MARKETS IN A NUTSHELL

After a disastrous second quarter, the South African stock market fell -1.92% over the third quarter. Despite this, on a year-to-date basis (01/01/2022 – 30/09/2022) the local stock market continues to be one of the better performing markets around the world.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2012/10/01 – 2022/09/30)

Source: Trading economics

It’s been a very eventful quarter which has, unsurprisingly, been quite volatile. As we have discussed in the first and second quarter summaries of 2022, a possible global recession has turned into a reality rather than conjecture. As the reality of a global recession has increased, so too has the uncertainty of how it will play out.

After a -11.69% fall in the second quarter of 2022, the local market initially recovered in July with a 4.22% return after which it fell -1.84% in August and -4.13% in September.

The biggest surprise during the quarter, was the weakening of the rand against the US dollar.

The local currency weakened significantly against the US dollar along with all other major currencies. The world is seemingly starved of US dollars, which is seen as a safe haven currency during times of uncertainty and distress. The rand fell 11.09% against the US dollar and 1.8% against the pound over the quarter.

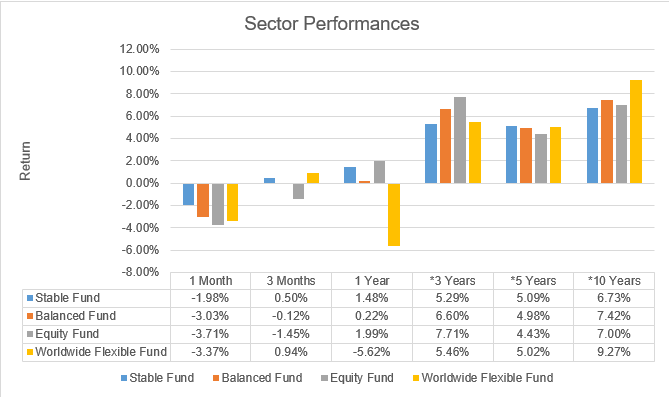

Source: Profile Data 30/09/2022

* Annualised Performance

Inflation and Interest rates: Where could it be heading and why?

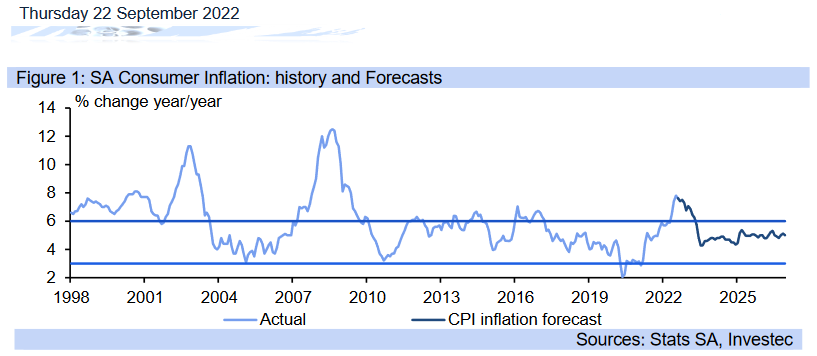

Inflation is very topical at the moment and unsurprisingly so as consumers have had to face gut-wrenching increases in food and fuel prices. The chart below shows the changing annual inflation rate going back to 1998. The last time the inflation rate was this high in South Africa was in 2009.

The chart also shows the South African Reserve Bank’s inflation target between 3% and 6%.

The chart also shows the inflation, actual and forecast, over the next several years. We can see how the inflation rate is assumed to have now reached its peak and is forecast (by Investec amongst other) to start to trend lower over the coming months.

Consumers are desperate to see inflation fall however, and in order for that to happen sooner rather than later the South African Reserve Bank has chosen to increase interest rates which encourages saving and discourages spending. This is commonly referred to as “Monetary Policy”.

Supply and demand 101: In theory, the less that consumers spend, the lower the demand and therefore the cost of goods would need to moderate (become cheaper). As interest rates go up people have less money to spend and therefore demand falls which should cause a lower rate of inflation.

The problem with this approach in South Africa is that the financially distressed consumer has had to borrow money to pay for their living expenses. In other words, South Africans on average, have lots of debt. As interest rates increase this debt becomes harder to pay off.

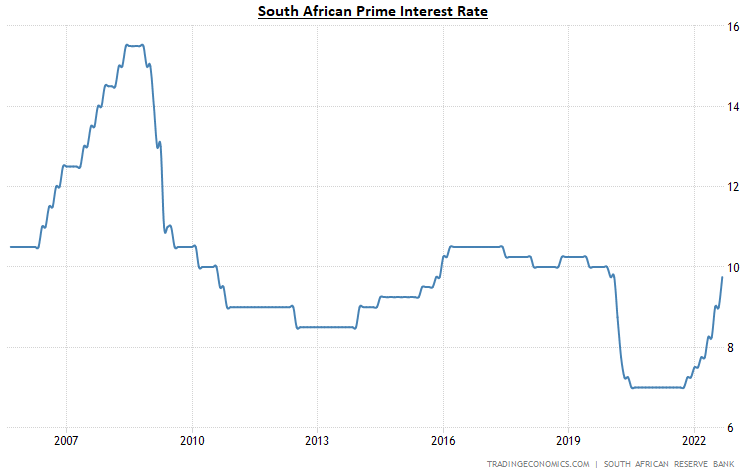

The chart below shows the South African lending rate which sits at 9.75%. Interest rates are likely to increase to 10.5% (prime rates) before the end of the year, with the possibility of another 0.75% hike in the first quarter of 2023. Simply put, consumers will be paying a high rate of interest on their debt during a period when unemployment is at record levels and inflation is high.

Consumers therefore need to focus on reducing their debt levels, as interest rates are unlikely to reduce meaningfully in the next few years.

As South Africans we fear the rapid devaluation in our currency with rampant inflation levels and no economic growth. Think Turkey, Venezuela, Argentina, Nigeria and need we say it, Zimbabwe.

The long-term trend for the rand is for it to weaken over time. But the rate of depreciation needs to be controlled.

The South African Reserve Bank defends the value of the Rand by making it attractive for foreigners to make use of our attractive interest rates or bond yields. This creates a demand for our local currency which increases the value of the rand, or slows the rate of depreciation.

Why is this so important? South Africa imports its fuel, medical equipment, vehicles and automotive parts, chemicals, digital devices such as cell phones, computers, TV etc as well as steel and other crucial materials which is needed to run the economy. If the South African Reserve Bank were to keep interest rates lower in order to help support local businesses and the consumer, it would potentially put our currency at risk which would make imported goods more expensive and further perpetuate the cycle.

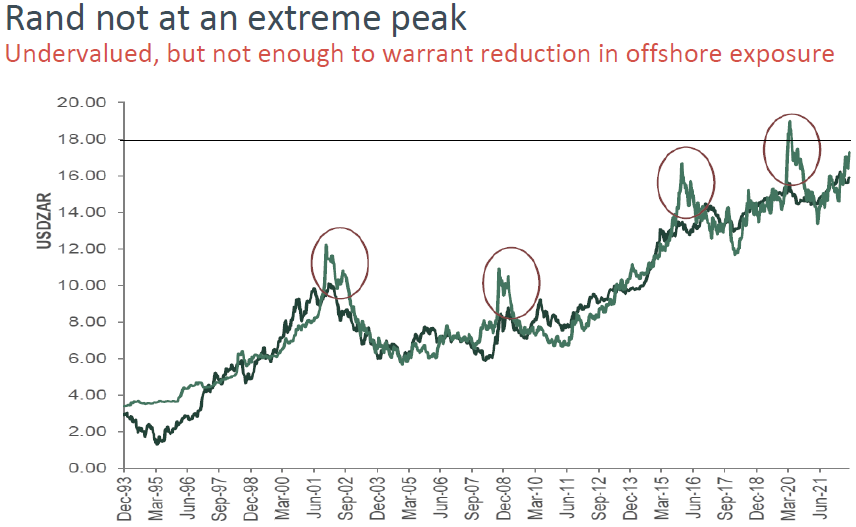

The chart below shows the rand-US dollar exchange rate over a long period of time, compared to the fair value of the rand as calculated by Foord Asset Management.

The dark green line is Foord’s estimate of fair value, whilst the light green line is the actual rand-US dollar exchange rate. During crisis periods such as the dot.com bubble or the global financial crisis, the rand tends to be overly weak as shown by the circled areas. This time is no different with the rand trading close to R18 to the US dollar. This would suggest that the local currency is becoming more expensive to send money offshore compared to a perceived fair value of between R14 – R16 depending on who you talk to.

Source: Foord Asset Management

Although the chart suggests that the rand is overly weak against the US dollar, it could continue to weaken to R20 if things were to continue to worsen. If this were to happen one would assume that this would only further strengthen the South African Reserve Bank’s resolve to continue to raise interest rates to defend our currency. This further suggests that interest rates are going to continue to be high and therefore consumers need to be mindful of debt over the next several years.

Setting the correct expectations for Q4 2022

During times of uncertainty, it’s important to have the correct expectations so that one is prepared for the range of outcomes that can take place over the next 6 – 12 months.

Since the beginning of the year, we have been cautioning investors on the volatility (fluctuation in value) that they can experience in their investments. Thus far 2022 hasn’t disappointed.

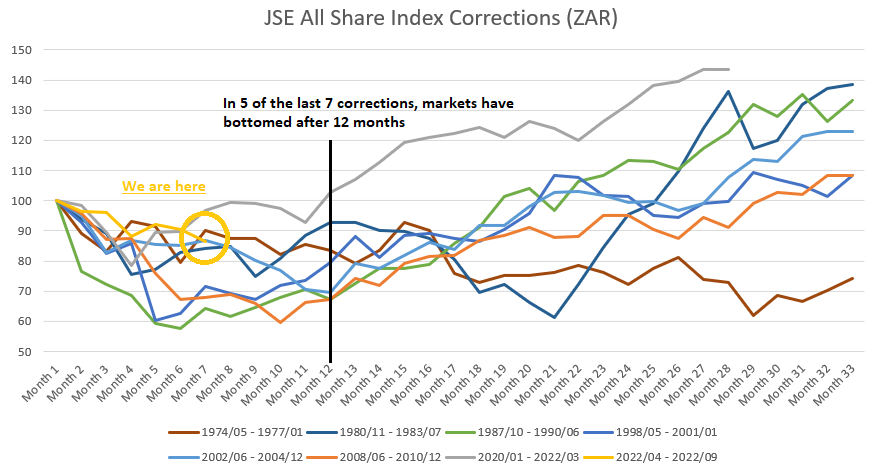

In the chart below we show the last seven market corrections (a meaningful fall in value) and the subsequent recoveries on the local stock market, as well as where we currently are in the 2022 correction.

In 5 of the last 7 market corrections, the market has bottomed out (fallen to its lowest point) within the first 12 months. This includes the Dot.com Bubble of the early 2000s and the Global Financial Crisis of 2008/2009.

The gold line illustrates where we currently are in comparison to other corrections in the local market.

Source: API, Profile Data and Firer, C and McLeod, H. 1999. Equities, bonds, cash and inflation: Historical performance in South Africa 1925-1998. Investment Analysts Journal No.50: 7-28

Based on where the gold line is on the chart, can one assume that there is a high probability of another 10% – 20% correction on the cards if history is anything to go by? The answer is that it is simply impossible to know for sure and therefore one needs to be careful of taking polarised positions with regards to their investments.

Multi-asset balanced funds are envisaged to be able to deliver strong returns over a very long period of time with less volatility or “risk” than the stock market. Great managers can achieve this through picking great companies (equities) as well as managing the risk in the fund depending on the risk factors in the market. In other words, if markets hold significant risk, balanced fund managers should be able to reduce their exposure to risk assets until such time that they feel that the market is cheap enough to warrant increasing their exposure to risk assets.

The table below shows the returns of well-known local multi-asset balanced funds from January to September 2022, compared to that of the local stock market which is depicted in the chart above.

|

Fund |

Year to date return (01/01/2022 – 30/09/2022) |

|

Allan Gray Balanced Fund |

0.32% |

|

PSG Balanced Fund |

-2.76% |

|

Ninety One Managed Fund |

-2.87% |

|

Foord Balanced Fund |

-4.47% |

|

M&G Balanced Fund |

-4.90% |

|

Nedgroup Core Diversified Fund (passive fund) |

-7.09% |

|

Ninety One Opportunity Fund |

-8.07% |

|

Coronation Balanced Plus Fund |

-8.39% |

|

FTSE/JSE All Share Total Return Index (local stock market) |

-10.07% |

Source: Profile Data

We can see how some of the funds have held up exceptionally well since the start of the year whilst funds such as the Ninety One Opportunity and Coronation Balanced Plus Fund have been more adversely effected by the volatility. The average year to date return (01/01/2022 – 30/09/2022) amongst the 8 balanced funds which are quoted above, is -4.88%. That is less than half of the volatility of the local equity market and is the benefit investors receive from good active asset allocation.

Key take aways for the fourth quarter

- The local market remains exceptionally cheap and therefore, despite the uncertainty it is prudent for long-term investors to hold growth assets such as local stocks.

- The next 6 – 12 months is likely to continue to be volatile.

- Local balanced funds are well positioned to protect investors capital when compared to the potential volatility that investors can expect from the local stock market.

OUTLOOK (LOCAL)

The outlook for local assets remains positive. Investors are reminded that according to most fund managers the expected return over the next 5 years for a balanced risk mandate, is for double digit returns. This is something which is desperately needed by South African investors on the back of recent poor returns. The return over the next 6-12 months will be largely driven by sentiment – a global recession, a divided ANC electoral vote or a sharp decline in commodity prices could materially impact South African listed resource companies.

The definition of Sentiment is “a thought influenced by or proceeding from feeling or emotion.” In other words, returns over a 6 – 12 months period can be largely driven by positive, negative, or indifferent emotions.

The rand appears to be overly weak against the US dollar. The local currency can continue to weaken as sentiment worsens however, the local currency does appear to be at somewhat of an extreme and therefore, on balanced of probability we may see the fund managers taking profits from their offshore exposure, in favour of local assets.

Interest rates are also forecast to continue increasing and therefore investor should consider reducing their liabilities before interest payments on debt become overbearing for consumers.

OFFSHORE MARKETS IN A NUTSHELL

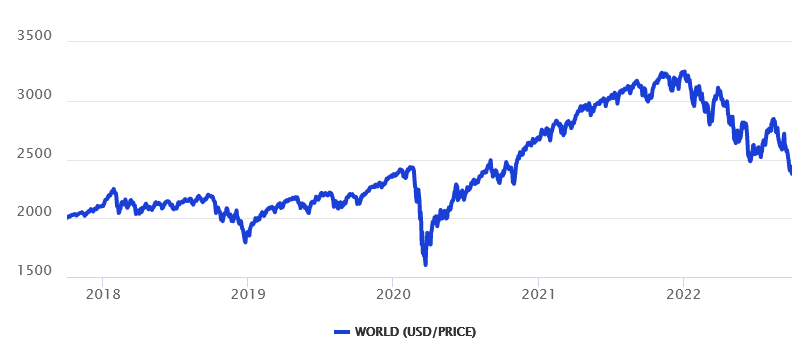

Global equity markets had another tumultuous period, closing out the quarter -6.19% lower in US dollars.

The graph below represents the World Equity Index over 5 years in dollar terms.

*Performance as of 30/09/2022

The third quarter of 2022 was yet another uncomfortable period of negative returns. The US market has fallen 24.81% since the start of the year whilst Emerging Markets have fallen 28.69% in US dollar terms over the period.

Inflation continues to wreak havoc on the consumer whilst interest rates continue to rise. The US dollar extended its gains over the quarter, particularly against the British pound in light of the UK’s somewhat dilutional plan to reduce the corporate tax rate in a high inflationary, high debt environment.

China didn’t miss its opportunity to make headlines over the quarter as it continued its draconian zero covid policy. Growth in China has been disappointing as economic activity has been throttled through policy decisions which are directed to contain any further outbreak of covid 19. China has seemingly been in a recession since the start of the year and as such, they have introduced monetary support in the second half of the year which is forecasted to continue during the remainder of the year and into 2023. Risks in the region do however remain elevated.

“I’m concerned about a global recession”

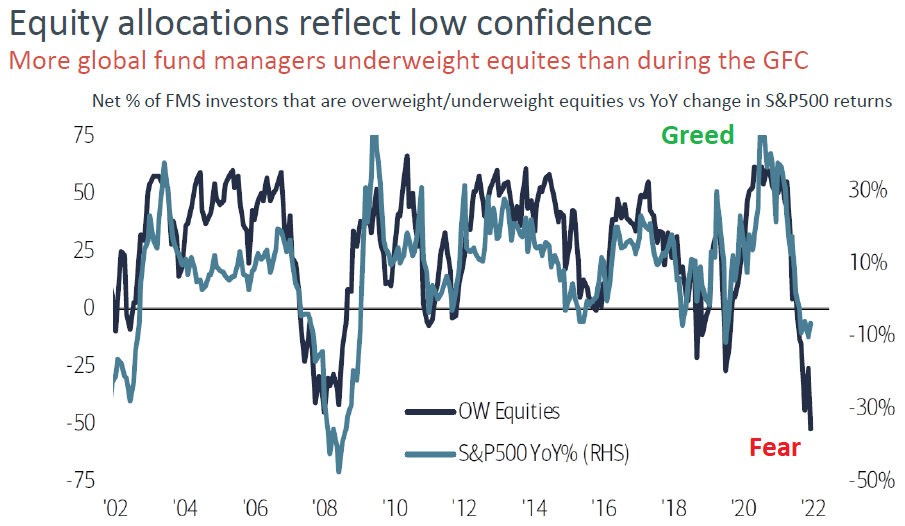

Last quarter we indicated that a global recession was “on its way” according to leading indicators. We also highlighted the fact that markets have already discounted themselves (to varying degrees) because of the expectation of a global recession. As emotive beings, in times like this it’s easy for people to base decisions on fear rather than logic as investors look to minimise the perceived pain that could be yet to come.

The chart below shows how global fund managers are more fearful now than they were at the height of the Global Financial Crisis as indicated by the fact that their “OW Equities” (overweight equities) position is in fact deeply negative. In other words, they too are fearful of how the next 12 months will play out and they are therefore underweight equities (growth assets).

Source: Foord Asset Management

We also discussed how markets move in cycles. Markets go up, markets go down and over time markets should trend upwards, as many of them have in the past. With the proverbial “crystal ball”, investors would be able to jump in and out of the markets at the right times.

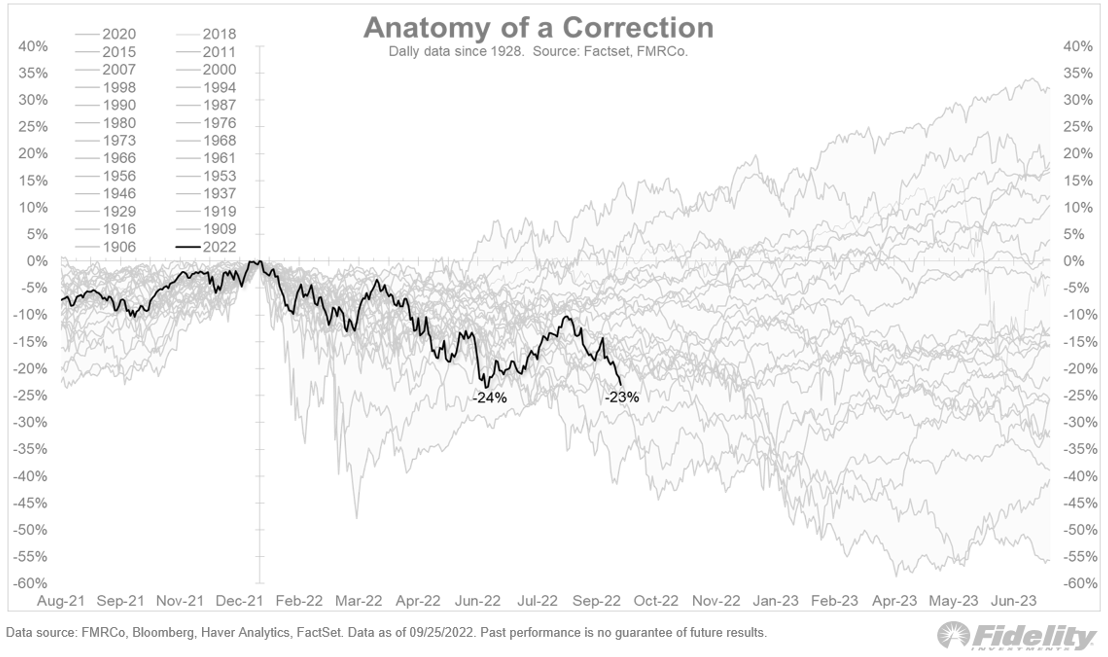

The chart below shows the “Anatomy of a Correction” using all the market corrections dating back to 1906. We can clearly see where the current 2022 correction is in comparison to the previous 25 corrections.

Where do you think the market will be in the next 9 months?

The reality is that it’s impossible to know for sure and therefore, one needs to be happy with holding on through the cycle to what is in one’s portfolio (assuming they are good investment managers) as opposed to trying to time the market, as the range of outcomes are so vast.

Is it possible for the market to fall another 10% – 20%? Yes. We’ve been cautioning investors that 2022 is likely to be a volatile year.

Global balanced funds are in the best position to shift the portfolio from being cautious to more aggressive in a relatively short amount of time. Therefore, it stands to reason that global balanced funds are well positioned to navigate the coming 6-12 months when compared to investor intervention in de-risking their portfolios by selling and waiting for new lows before buying back in – a strategy which has been shown to have a high rate of failure.

FORWARD OUTLOOK (OFFSHORE)

The outlook for global markets remains uncertain. The fourth quarter of 2022 will continue to be volatile. The market could see another 10% -20% decline in value. Having said that, many managers are very optimistic about the potential for great returns over the next 3 – 5 years based on how cheap assets currently are. Unfortunately, the market needs to find its bottom before we can see a sustained recovery, and therein lies the uncertainty. Managers are therefore cautious as shown by their relative underweight positions in equities, however they have not entirely abandoned their equity exposure due to the attractiveness in price.

The war in Ukraine continues to be a worrying factor with the Russian president conscripting what is believed to have been over 200 000 people since the 21st of September.

If you are concerned about your investments, we urge you to make contact with your financial adviser.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.