2023 THIRD QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

The South African stock market gained 0.66% over the second quarter of 2023.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2013/07/01 – 2023/06/30)

Source: Trading economics

In February South Africa was grey listed for our inability to combat money laundering and financial terrorism. President Ramaphosa responded to the news by saying that it has given us an opportunity to improve. Less than three months later, the controversial Lady R, a sanctioned Russian cargo ship was allegedly loaded at a South African port with arms and ammunition.

In response to the news, the rand sold off heavily ending the quarter around 6% weaker against the US dollar and around 9% weaker against the pound. Thankfully the local market was less perturbed by the news.

From a geopolitical perspective, South Africa has apparently chosen its side which is could see us being removed from preferential trade agreements with the west. Once again, President Ramaphosa has responded by addressing world leaders at the Global Financing Pact Sumit in Paris, stating “we are not beggars, treat us as equals”.

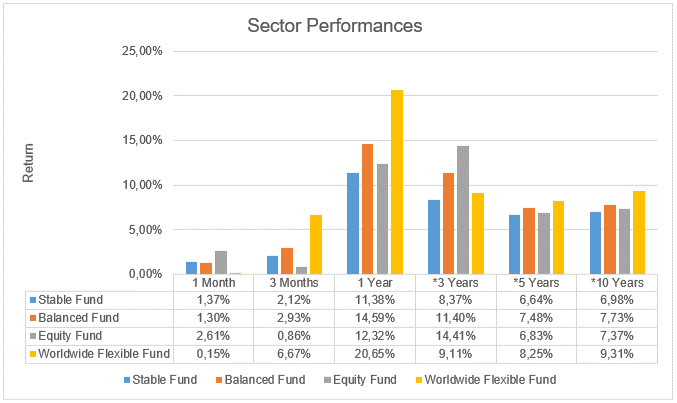

Source: Profile Data 30/06/2023

* Annualised Performance

The Disaster of NHI in South Africa

A topic which has had less media coverage than it should have, has been the passing of the NHI bill by parliament and the ramifications that will arise as a result of it, in the coming years. Government along with national treasury, has yet to clarify how it will be funded. A minor detail …

Most South African’s are unaware that a NHI pilot project was established in 2012 and was completed in 2017. As one may have guessed, the project highlighted numerous issues which were published in various reports. It was concluded that there were the following issues:

- Incomplete infrastructure projects

- Internet connectivity issues

- Staffing challenges

- Changing standards and training manuals

- Lack of follow-up on referrals

- Costly contracting of general practitioners

- Challenges with specialist teams

South Africa has shown that it is incapable of running a profitable state-owned enterprise that meets its service delivery obligations. Why would NHI be any different? Dr Xolisile Ngumbela of the University of Johannesburg has stated that there should be an NHI in South Africa, however it should be done as a public-private partnership, suggesting that government can “not be trusted” to run NHI.

Business Leadership South Africa CEO Busi Mavuso, has also warned that NHI, as envisaged in the Bill, would leave all South Africans worse off, and the system should rather consist of a private-public partnership.

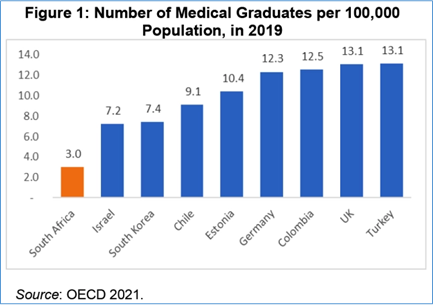

One of the issues with South Africa’s healthcare system is the lack of medical healthcare professionals. As the chart below shows, in 2019, there were 3 medical graduates per 100,000 people.

Profmed CEO Craig Comrie suggests that if NHI is fully implemented, doctors would essentially be nationalised and it would cause medical professionals to leave the country.

The consensus regarding any workable solution for an NHI scheme in South Africa, is one of public-private partnership.

All things considered, the NHI bill does not bode well for the South African health care system as a whole. There are simply too many issues to contend with and given our poor track record of wasteful expenditure and corruption, NHI could present itself as “low hanging fruit”.

Although the bill has been passed, there is still a great deal that needs to be clarified and considered before there is any implementation. From a South African perspective, it could take many years to implement NHI during which time, NHI may be very different to what is envisaged in the current bill.

“The bill (even if it becomes an Act) still faces an uphill battle from critics, opponents and stakeholders in the private sector who have already launched legal challenges against the laws.

Several stakeholders – from the private sector, legal firms and from Parliament’s own legal advisors – have flagged several key issues in the bill as it currently stands, including serious constitutional problems. It is unlikely that these glaring holes will go unchallenged.

And even without the potential delays caused by court orders and other hurdles, the Department of Health itself has conceded that the NHI will not be fully implemented any time soon.

The scheme is expected to roll out in phases, starting in 2026.

Deputy Director General of National Health Insurance, Dr Nicholas Crisp, said the intended outcomes of the NHI will only be realised in 15 to 30 years, and the laws currently being processed lay the groundwork and framework for this reality.”

BusinessTech – NHI: What comes next. Published 5/07/2023

The Chinese bull case for a South African equities

The South African equity market has a high corelation to the Chinese stock market. Particularly over the last 20 years. There are various reasons why this is the case. This corelation is high and typically holds true over longer periods of time.

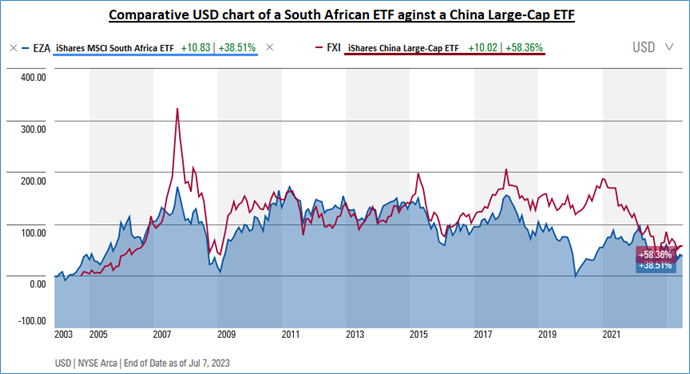

The chart below shows the US dollar performance of a South African ETF in blue, against the performance of a China Large-Cap ETF in red. The chart spans a period of around 20 years.

One can see that both ETF’s follow the same general performance trend over time. The largest deviation occurred from September 2020 to September 2022 – The covid crash and recovery. After which, the high corelation and trend reasserted itself.

Source: Morningstar

A recovery in the Chinese stock market could likely benefit the South African stock market.

According to an Alpine Macro report in December 2022, they expect the Chinese economy to have mostly recovered from the covid driven lows by the second half of 2023.

“Our best guess is that the Chinese economy could recover to 80% of its capacity toward mid-2023, and a post-pandemic boom could unfold in the second half of next year.”

2023 Outlook: Disinflation And Desynchronization – Alpine Macro

Despite the Chinese economy reopening in 2023, their stock market has yet to see a meaningful recovery. Closing the first half of the year, down marginally in US dollar terms.

Despite some recent weaker macroeconomic data, the Chinese economy is seen to be firmly in an early economic recovery phase.

The quote below shows three key insights into the Chinese reopening theme, by global asset manager, T Rowe Price.

Key Insights

- Despite some softer macro data recently, the initial stage of economic reopening largely met our expectations, with the services sector leading the way.

- We expect the recovery to broaden with some bumpiness due to the volatile base, uncertainties in the external economy, and geopolitical tensions.

- The regulatory environment should normalize, with more support for the private sector. Valuations are attractive versus growth for China equities.

China Midyear Market Outlook – T Rowe Price

The consensus view is for a continued economic recovery in China throughout the remainder of 2023, leading into 2024. It stands to reason that as corporate earnings begin to recover, so would the Chinese stock market.

Despite the positive outlook for China, the geopolitical risk remains an issue. This is likely to lead to heightened volatility throughout the remainder of 2023 as well as 2024.

All else being equal, China remains a bullish theme for South African equities.

OUTLOOK (LOCAL)

The outlook for the South African stock market remains positive, despite repeatedly scoring some “own goals”. These own goals have led to a severe weakening of our currency, against our developed market peers. If the rand remains over R18 to the US dollar, our inflation rate is likely to be stickier, thus hurting the already battered consumer.

Both our equity and fixed income market continue to offer attractive value from a risk adjusted return basis. It is believed that the China economic recovery theme could also have a significant uplift on the price of local assets.

From an economic perspective, economists continue to sound the alarm over deteriorating fundamentals. Several economists, CEO’s and prominent businessmen and women have raised concern around the threat of social unrest and even food security. The silver lining in the doldrum of economic discontent is that the energy crisis is likely to be less acute in 2024 (an election year), as the private sector looks to privatise their energy capacity.

Local assets, whilst generally regarded as attractive, are nevertheless likely to remain volatile over the remainder of the year.

OFFSHORE MARKETS IN A NUTSHELL

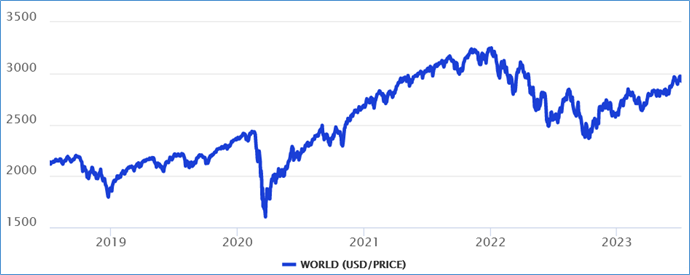

Global equity markets continued to deliver attractive gains over the second quarter. The MSCI world equity index was up 6.83% over the quarter in US dollars.

The graph below represents the World Equity Index over 5 years in dollar terms.

*Performance as of 30/06/2023

The first half of 2023 has led to relatively attractive market returns despite the level of volatility that investors have had to endure. The Chinese market has been a clear outlier having posted a negative return of 5.46% in US dollar terms.

Inflation data around the world has shown that inflation is continuing to fall. The US labour market remains an area of contention as it remains very buoyant given the economic climate. A robust US labour market could see inflation remain higher for longer.

Leading economic data continues to suggest that a US recession is likely. The long-awaited recession has surprised many experts who had suggested that it would have already started to unfold. According to the New York Fed, there is a 71% probability of a recession. In contrast, Goldman Sachs has lowered the probability of a recession over the next 12 months to 25%.

Don’t be tempted into timing the market: The odds are against you

Coming into 2023, the consensus outlook was for a better year overall, despite the view that the returns in the first half of the year could be more disappointing than the latter half of the year. As it so happens, with the exception of the Chinese market, returns have been very pleasing. This is not to say that the market won’t experience further pullbacks in its price (which we refer to as volatility), over the remainder of the year.

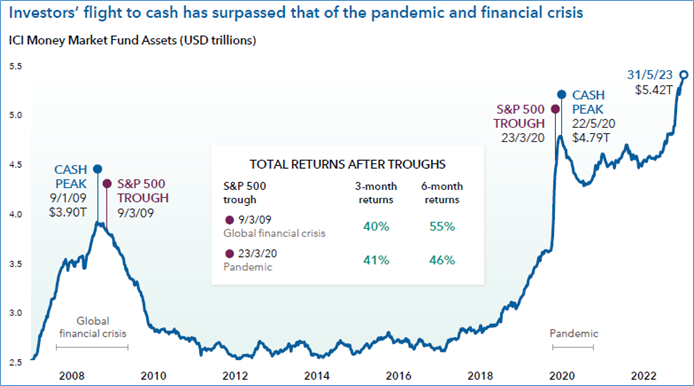

The chart below speaks to the fact that many investors have chosen to flee from growth assets, to cash, particularly over the last year. Ironically, the world equity market is up almost 20% in US dollar terms, over the last year.

The blue line shows the amount of cash held by investors since 2007, just before the Global Financial Crisis. Where cash levels have increased, market certainty and returns have decreased as a result of fear. The purple dots show the points at which the S&P 500 index bottomed during the last two recessions. What we can see is that by the time the market has bottomed out, investors are still holding onto extremely high levels of cash.

After the market bottomed in 2009 and 2020, the S&P 500 return 40% – 41% over the next 3 months, during which time, investors were still deploying their high levels of cash.

Source: Capital Group

As we can see, cash levels sit at yet another extreme as fear grips investors’ expectations.

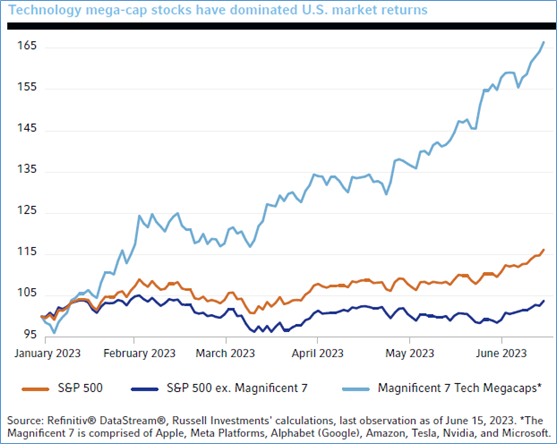

The chart below shows that thus far in 2023, the S&P 500’s spectacular return has predominantly come from a handful of technology stocks. Seven to be exact. Whilst the remaining constituents in the index have been relatively flat.

In a market where there is such a high concentration of select winners, the risk of volatility remains elevated. The silver lining to this scenario is that the opportunity set of high quality, cheap companies continues to grow.

The view at this point is the cycle is that market fundamentals should start to improve by the end of the year leading to a positive outlook for returns in 2024.

“We believe the second half of 2023 offers opportunities for investors to get cash off the sidelines. There will be challenges, and a vertical bull market is hardly our view. But the opportunities on offer—near and longer term—point to a simple conclusion. It is time to engage more fully.”

Stephen Dover Chief Market Strategist Franklin Templeton Institute

Investors shouldn’t be looking at the next 6 months. That is the job of asset managers. Investors should take a 3 – 5 year view, led by a comprehensive financial plan that can help to anchor investment decisions without trying to time the market.

FORWARD OUTLOOK (OFFSHORE)

The US may or may not enter the much-anticipated recession which has thus far eluded their economy despite the rapid rate hikes and consistently deteriorating fundamentals. The recession argument is no longer a consensus view when compared to the beginning of the year. At this point, the mainstream view is that should a recession occur, it is unlikely to be as severe as previous recessions.

For investors who hold multi-asset funds such as global balanced funds, the opportunity set in select global bonds appears very attractive. This could help complement pleasing equity returns over the coming years.

Geopolitical risk remains elevated. Tensions between the east and west could be a source of volatility over the remainder of the year. The opportunity set for active managers to exploit, continues to grow.

We would expect market volatility to continue, particularly whilst the US labour market remains fairly robust, contributing to sticky inflation. The US central bank has suggested that it may pursue two more interest rate hikes before it has reached its peak. As economic data continues to come out, this guidance may change, and markets may react favourably or unfavourably depending on the data. Regardless, the outlook over the medium term remains positive and therefore short-term views could lead to poor investment decisions.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.