2024 SECOND QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

The South African stock market fell -2.25% over the first quarter of 2024. Resources fell -3.26% whilst financials fell -6.13% the quarter.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2014/04/01 – 2024/03/31)

Source: Trading economics

Uncertainty over the upcoming election has driven a weak appetite for local assets. Investors and businesses appear to be taking a wait-and-see approach. The latest poll from the Social Research Foundation suggests that the ANC could receive as low as 37% of the voter share whilst the newly formed MK party could receive as much as 13% of the voter share.

The February budget speech was met with mixed emotions. It nevertheless had no effect on the market or the currency with investors once again, taking a wait-and-see approach.

Precious metals such as gold hit a new all time high over the quarter, supported by lower global interest rates, increased geopolitical risk and central bank purchases.

Loadshedding improved over the quarter as more sources of renewables continue to make a difference to the overall supply of electricity.

Interest rates in South Africa, are expected to decrease largely in line with that of the US. According to various economists, recent US inflation data suggests that the US central bank may have to delay the first cut in interest rates to later on in the year. This could effectively mean that interest rate cuts in South Africa could also take longer than anticipated.

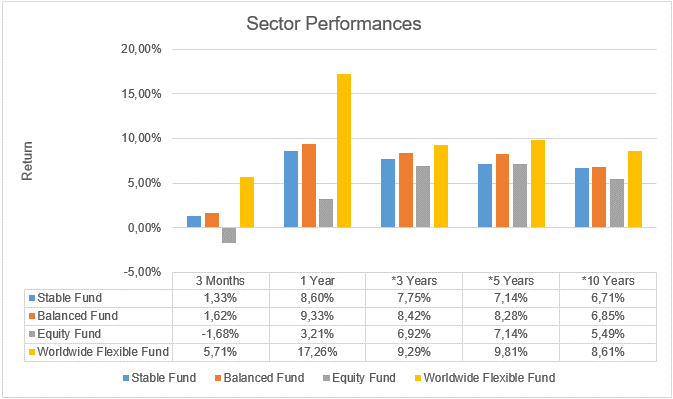

Source: Profile Data 31/03/2024

* Annualised Performance

OUTLOOK (LOCAL)

With arguably the most important election in South Africa’s democratic history around the corner, markets seem to be taking a wait-and-see approach. The elephant in the room is which coalition will govern South Africa and how that will play out over the coming years.

One can speculate on the various scenarios that could flow from the election. It could conceivably include an outcome where various political parties don’t accept the election results, which could lead to civil unrest. Election forecasting, as interesting as it might be, particularly at this juncture in our history, is not something that the market is willing to base investment decisions on.

There has already been concerning rhetoric from parties such as the EFF who have proposed a coalition with the ANC on the basis that their deputy president Floyd Shivambu is appointed as the country’s finance minister, amongst other things. It’s a scenario which would likely result in a collapse in the rand and local disinvestment. This “doomsday scenario” is unlikely according to Frans Cronje, a respected economic and political analyst. The rhetoric nevertheless, leads to fear and uncertainty. In a recent interview, Ninety One Deputy Managing Director Sangeeth Sewnath reminds listeners to “follow the trends and not the headlines”.

Investors should continue to expect extreme rhetoric over the second quarter. Asset managers are cognisant of the risks and the opportunities with some managers holding a high allocation to direct offshore assets whilst others are holding on to higher levels of cash.

After the local election, the outlook will become clearer, even if it simply serves to rule out the most extreme “dooms day” outcomes that South Africans are so fearful of.

In the context of the local environment, one must acknowledge the impact that global forces can have on our market and economy. There are still several global macroeconomic factors that can have a positive effect on South African assets.

OFFSHORE MARKETS IN A NUTSHELL

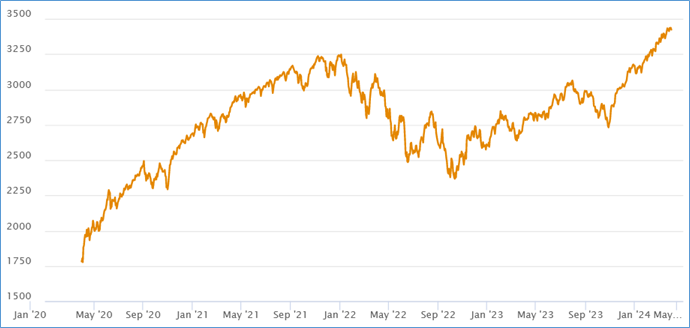

Global equity markets had a breathtaking quarter. The MSCI world equity index gained 9.01% over the quarter. A resilient US economy and ongoing enthusiasm around artificial intelligence, coupled with the expectation of interest rate cuts, led to higher stock prices, particularly in the US.

The graph below represents the World Equity Index over the last 4 years in US dollar terms.

*Performance as of 31/03/2024

With a resilient US economy and US inflation falling slower than anticipated, the market had to adjust its expectations around interest rate cuts in for the year. Why is this important? Interest rate cuts are historically very positive for asset prices, and the market appears to have already priced them in as seen by the exceptional return in equities (stocks) over the first quarter.

The market now expects 3 rate cuts over the course of the year, rather than the previous expectation of 6 rate cuts going into 2024. If inflation data comes out as being stickier over the coming months, the market may yet again have to alter its expectations. These short-term concerns shouldn’t mask the bigger picture which is for continued growth in both corporate earnings as well as economies around the world.

Chinese equities continued to disappoint over the quarter with the MSCI China Index falling -2.19% whilst the MSCI Emerging Market Index returned 2.37% for the quarter. A difference of 4.56%. Investors remained concerned about China’s growth prospects in the absence of any meaningful fiscal stimulus.

Follow the trends and not the headlines

With the world equity index up 9% over the first quarter, what is one to expect for the remainder of the year? Can markets continue to soar higher?

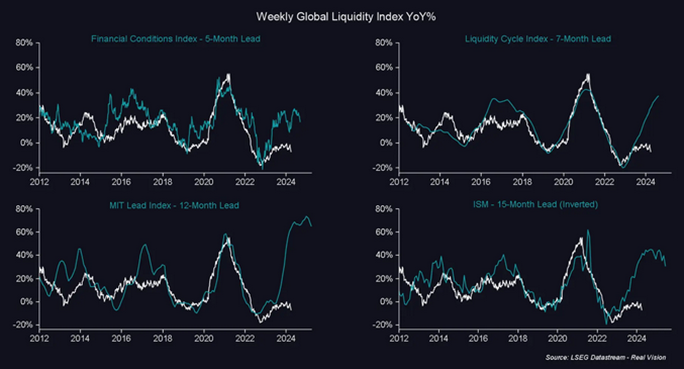

The charts below show various leading indicators (in green/blue) against global liquidity (in white). Without discussing the charts in any detail, one can see that according to the leading indicators, global liquidity is forecast to improve.

Historically, when global liquidity increases, risk assets such as equities or stocks tend to increase in value as well. We can confidently state that we do not know where markets will be at the end of the year. Forecasting such short-term movements is anyone’s best guess. What we take comfort in, is the improvement in the global liquidity cycle.

Inflation continues to fall from its 2022 highs. Although, the rate of decrease has begun to slow, leading to some concerns that global inflation or US inflation in particular, may remain higher than what was previously thought.

Why does this matter?

If inflation stalls at its current levels, particularly in the US, interest rates may have to stay higher for longer, which could be negative for global liquidity. In other words, not necessarily good for risk assets such as equities or stocks.

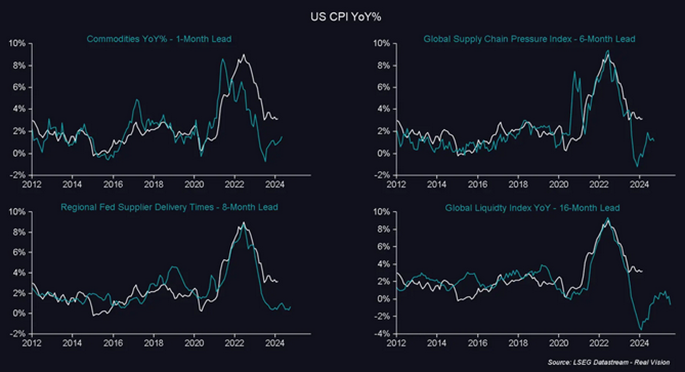

The charts below show various leading indicators (in green/blue), overlayed with US inflation (in white). Simply put, the leading indicators suggest that US inflation should continue to fall.

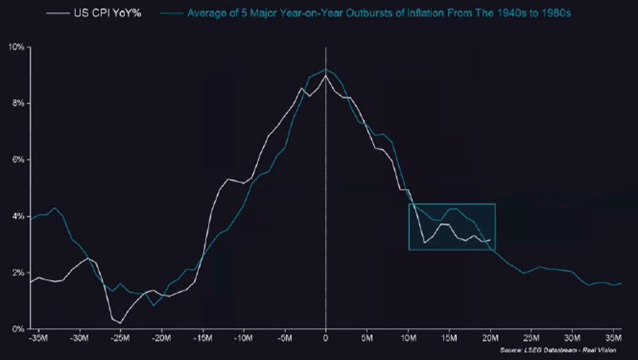

As the chart below shows, the sidewards movement in the annual inflation rate in the US is “nothing unusual” at this stage of the cycle.

Julien Bittel Head of Global Macro Research at GMI highlights the “tug of war” going on between goods inflation and services inflation which he describes as “extremely normal at this stage in the cycle”.

From a macro economic perspective, based on the data above one can expect inflation to continue to moderate and for global liquidity to continue to increase.

If that trend continues, it could be very positive for risk assets such as equities or stocks.

Risks to the trend include:

- Geopolitical tensions.

- Election surprises.

- Radical shifts in economic policy.

- A shock to energy prices.

FORWARD OUTLOOK (OFFSHORE)

The positive outlook remains intact. The US elections in November are heating up as a Trump/Biden race for the White House seems all but certain. Once again, the American electorate and the world could see a less than competent politician dictate foreign policy for the next four years.

Geopolitical tensions continue to escalate in the middle east, whilst the market continues to wait for Chinese stimulus to bolster asset prices.

Interest rate cuts, although still on the cards, is expected to take place later in the year, than what was previously thought. As discussed earlier, inflation is still expected to continue falling although there may be parts of the inflation basket that remain elevated and take longer to fall.

If the conflict in the middle east escalates between Israel and Iran, possibly drawing in other countries in the region, the world may see increased volatility in asset prices.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.