2024 THIRD QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

The South African stock market gained 8.19% over the second quarter of 2024. Resources were up 3.85% whilst financials recorded a staggering 15.38% over the quarter. Local South African centric stocks, commonly referred to as “SA Inc stocks” rose by 10.29%. The local bond market also had a positive quarter up 6.85%

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2014/07/01 – 2024/06/30)

With the much-anticipated election now over, attention shifts to how the GNU will payout over the coming months and years.

The rally in local financials and other SA Inc shares is a testament to how quickly sentiment can shift.

South Africa also recently experienced over 100 days without loadshedding. The South African Reserve Bank (SARB) noted that loadshedding accounted for an estimated 50% reduction in GDP (economic growth) in 2022. South Africa grew at around 2% in 2022. According to the SARB’s statement the country should have seen growth closer to 4%. As we continue to see an improvement in loadshedding, South Africa should continue to see in improvement in economic growth which in turn, will have a positive effect on the consumer.

The rand had a very volatile quarter trading between R19.35 and R17.86 to the US dollar. That equates to a range of 7.85%. The rand started the quarter at R18.86 to the US dollar and closed out at R18.18.

The rand experienced similar volatility against the pound over the quarter, trading between R24.30 and R22.58. That equates to a range of 7.65%. The rand started the quarter at R23.84 to the pound and closed out at R22.99.

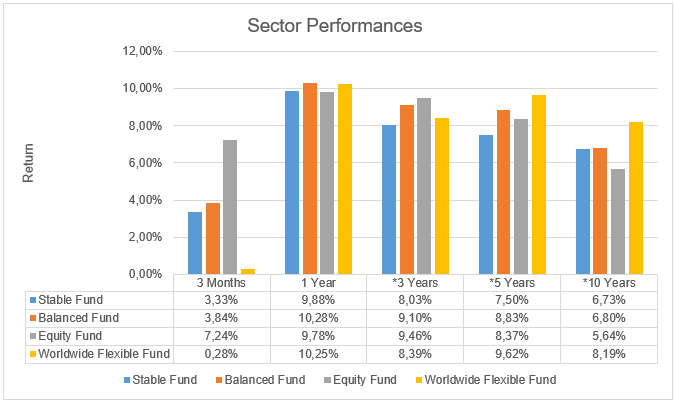

Source: Profile Data 30/06/2024

* Annualised Performance

Reality After The Local Elections

At the end of June, almost a month after the national election, we published an article titled “Reality After the Elections”. This was in response to the queries that we were receiving from anxious investors. We encourage you to read it on our website. www.api.za.com/reality-after-the-elections/

There were three key takeaways:

- The election outcome was perhaps the best outcome that we could have hoped for as it has led to the peaceful transition of power to a collective government of national unity (GNU). One assumes it is a precursor to changing the tides of South Africa’s future. The 10 members of the GNU have thus far excluded the radical and divisive forces of the MK and EFF. There is much to be hopeful for going forward.

- Maintaining a functional government at both the national and provincial level is going to be very difficult. There are a diverse range of ideological views from parties within the GNU including NHI, radical economic transformation and how to stimulate economic growth and reduce unemployment. Finding consensus around these issues is likely to be problematic. Particularly as we get closer to the 2029 national election, where we may also see electioneering and campaigning having a divisive effect within the GNU.

- One would ultimately need to see how the GNU plays out, but without the necessary reforms and their successful implementation, it may be compelling to expect more of the same – deteriorating financial and economic fundamentals. Perhaps to a lesser extent than under the previous majority led ANC government. All things considered, one may argue that it is reasonable to expect conflict, disagreement, disputes and a general lack of discord within the GNU over the coming years.

The sobering question that one must contemplate is how to balance the optimism and euphoria over the historic outcome with the reality of what has to be addressed in the complex plethora of challenges and crises that the nation faces.

Given the history poor leadership, corruption, economic and social deterioration over the last decade, it’s all too easy to have a negative view of South Africa. After the announcement of the national cabinet, one can see that there is potential for real progress to be made over the next 5 years. But progress in the context of South Africa’s challenges, will take time.

“Analysts are starting to feel more hopeful about the country’s growth outlook, and although this will take some time to come to fruition, business and consumer confidence should pick up more immediately.”

Kim Silberman, Macro Economist and Fixed Income Strategist at Matrix Fund Managers.

In the meantime, economists such Investec chief economist Annabel Bishop note that despite positive sentiment the GNU and new cabinet are not expected to significantly impact the growth outlook. At least, not in the short term with growth expectation remaining around 1% for 2024. However, Bishop reaffirms the view that they “continue to forecast growth approaching 3.0% by 2029”.

At a provincial level, the surprise coalition in KZN between the IFP, DA, ANC and NFP have kept the MK and EFF at bay. A surprising turn of affairs after the MK received 45% of the votes.

As we have recently seen in Gauteng, a provincial government majority led by corruption accused Premier Panyaza Lesufi, includes the ANC, IFP, PA and Rise Mzansi. With the DA and ANC unable to come to an agreement, the DA who received 22 out of the 80 seats in the provincial legislature, will now take its place on the opposition benches. A stark reminder of fragility amongst political parties and the reliance on reasonableness in both the GNU as well as at a provincial level (GPU), to act in the interest of the people and not in the interests of their own political parties or individual members.

We can only hope that despite ideological differences and disagreements, the GNU remains relatively stable and is able to function as it is intended.

How are South African Asset Managers Positioned?

As asset managers weigh in on the evolving outlook for South Africa given the outcome of the election, one is reminded of the opportunities and complexities within the South African context.

In a recent global investor conference that took place before the May election, Allan Gray portfolio manager, Jithen Pillay discussed the challenges of the past decade with SA Inc shares (companies that are reliant on the local economy or consumer) being at historically cheap levels – and for good reason.

Pillay notes that there is a very attractive opportunity for selective stock picking whilst also underpinning the challenges that some companies and sectors continue to face. The effects of loadshedding have had a stark impact on profitability over the years. Local companies that have been able to grow have often done so by taking market share from competitors. An example of this is Shoprite and Pick n Pay. Over the past 20 years Shoprite’s revenue has more than doubled compared to that of Pick n Pay. With most of the progress having occurred over the last decade.

So what needs to change?

Pillay highlights two obvious factors. The one which is perhaps more complicated for investors to understand is that the cost of capital needs to come down. In other words, it needs to be less expensive for companies to access money which in turn, can be used to invest in operations.

The other and more obvious factor is that we need to see economic growth. Within this factor, there are aspects which we can control such as reducing loadshedding which will have an immediate impact on growth. There are also aspects which we can’t control such as the effect of China. In previous commentaries, we have spoken about South Africa’s commodity driven economy and therefore its reliance on China as the world’s largest consumer of industrial commodities.

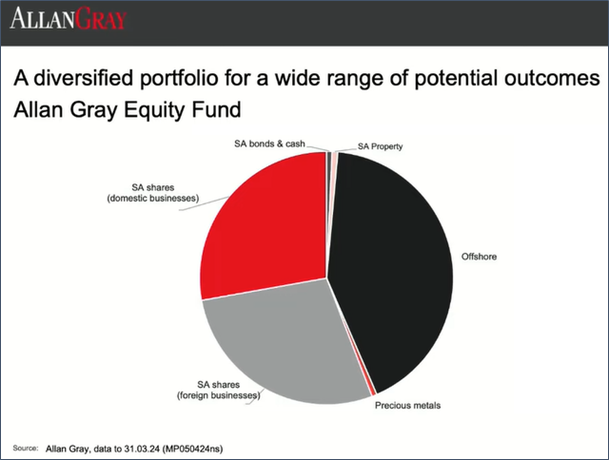

The chart below shows the underlying exposure of the Allan Gray Equity Fund at the end of March.

In light of Pillay’s comments, we can see that the fund has almost maximised its direct offshore exposure which by regulation, is limited to 45% of the fund. Of the remaining exposure, the listed South African shares are divided into SA listed foreign businesses and SA listed domestic businesses. When one looks at the portfolio as a whole, around 2/3rds of the portfolio is invested in foreign businesses, be it listed in South Africa or globally.

At the same global investor conference, CIO and portfolio manager at 36ONE, Cy Jacobs shared his views on SA Inc shares (SA listed domestic businesses). Jacobs acknowledges much of the same challenges that were highlighted by Pillay. Jacobs however, notes that within the next year or two, loadshedding should largely be a thing of the past. Thereby unlocking growth potential. As a commodity exporter, the issues with our ports and rails are also a significant hindrance to growth. Jacobs highlights the management changes at Transnet that is improving operational efficiencies as well as upgrades to infrastructure, albeit slowly.

“The implementation of key structural reforms + lower interest rates and a global economy upswing in 2024 – could start to improve SA economic performance over the next few years”.

Cy Jacobs, CIO and Portfolio Manager at 36ONE Asset Management

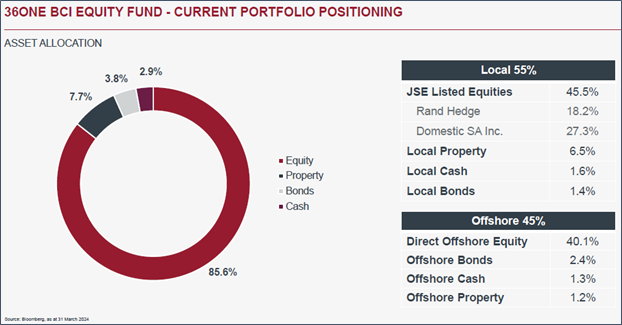

The table below shows the underlying exposure of the 36ONE Equity Fund. As of March, the fund had maximised its direct offshore exposure at 45%. Of the local listed equities, 27.3% was invested in local listed global businesses whilst the remaining 18.2% was invested in local listed domestic businesses. The fund therefore held just over 2/3rds of its exposure in global businesses. Not dissimilar to the Allan Gray Equity Fund.

So, what is the message here?

Despite the attractiveness of local listed domestic businesses, many asset managers continue to hold the majority of their equity exposure to global businesses. Either listed in South Africa or abroad. As Pillay states, “we don’t think it’s a dripping roast”. Asset managers do, however, hold select local listed domestic businesses that are considered to be good businesses that are simply too cheap to ignore. A simple shift in sentiment could see them up 20% – 30%.

As Jacobs points out, loadshedding is improving with South Africa having gone over 100 days with no loadshedding. As interest rates fall, and the global economy, and China in particular start to recover, South Africa and local listed domestic businesses could see a marked improvement in growth, profitability and a reduced cost of capital.

Asset managers such as Coronation continue to favour global businesses to local listed domestic businesses as they see better opportunity at lower risk. This emphasises the fact that despite the opportunity in local listed domestic businesses, we need to see the implementation of key structural reforms which is at the mercy of politicians and the newly formed GNU.

OUTLOOK (LOCAL)

With the election over, and a GNU in place, we need to see tough decisions being made to bring about structural reform. In the absence of structural reform, South Africa potentially faces more of the same – deteriorating financial and economic fundamentals.

Maintaining a functional government at both the national and provincial level is going to be very difficult. There are a diverse range of ideological views from parties within the GNU including NHI, radical economic transformation and how to stimulate economic growth and reduce unemployment. Finding consensus around these issues is likely to be problematic. It is reasonable to expect conflict, disagreement, disputes and a general lack of discord within the GNU over the coming years.

We can only hope that despite ideological differences and disagreements, the GNU remains relatively stable and is able to function as it is intended.

Asset managers remain cognisant of the risks inherent in South African assets. However, the potential for attractive returns, from equities in particular, have shifted to the upside. A mere shift in sentiment could see South African equities up 20% – 30%.

OFFSHORE MARKETS IN A NUTSHELL

Global equity markets had another positive quarter. The MSCI world equity index gained 2.63% in US dollars over the quarter. Over the period the world equity index excluding the US market was down -0.6%. In stark contrast, emerging markets posted a 5% return.

The graph below represents the World Equity Index over the last 4 years in US dollar terms.

*Performance as of 30/06/2024

In the first half of 2024 the US stock market, as measured by the S&P 500 index, has delivered a return of over 15% whilst the equally weighted S&P 500 index (where the return is derived equally from each of the 500 components) has only returned 4% over the period. Just 4 stocks (Nvidia, Microsoft, Alphabet and Amazon) have contributed more than half of the gain in the S&P 500 with Nvidia accounting for over 30% of the index return in the first half of the year. The market concentration of the top 10 stocks has reached highs last seen prior to the great depression and well in excess of the Dot.com bubble in the early 2000s.

Going into 2024, the expectation was for a broader performance within the market. In other words, it was expected that the market return wouldn’t be driven by a handful of stocks. The good news is that as interest rates fall, a larger percentage of stocks should benefit leading to a widening opportunity set for attractive returns.

Chinese equities had a strong performance in the second quarter, gaining 7%. For the first half of the year the MSCI China index has returned just under 5%, whilst the emerging market index is up 7.49%. A recent Mckinsey report notes an improvement in consumer sentiment as well as consumer spending. Although China faces structural challenges in its property sector which has been a significant driver of economic activity, the economy is showing signs of a recovery with supportive stimulus being slowly introduced.

All Eyes On The US Election

As we pass the midpoint of 2024, there have been over 30 national elections with as many more to come. None are as potentially influential as that of the US which is due to take place in November 2024.

The much-anticipated US presidential debate was recently concluded between a candidate that many would regard as a narcissist and convicted felon, and another with severe mental limitations that has him at times struggling to finish coherent sentences.

The recent presidential debate which included an argument about who had a lower golf handicap and who could drive the ball further, has been called an “unmitigated disaster” for Biden. Unsurprisingly, recent polls show Trump leading Biden by a few percentage points.

As polling data is released and the rhetoric heats up between the two presidential candidates, markets will begin to price in likely scenarios. This means that volatility can be expected as we lead up to the November election.

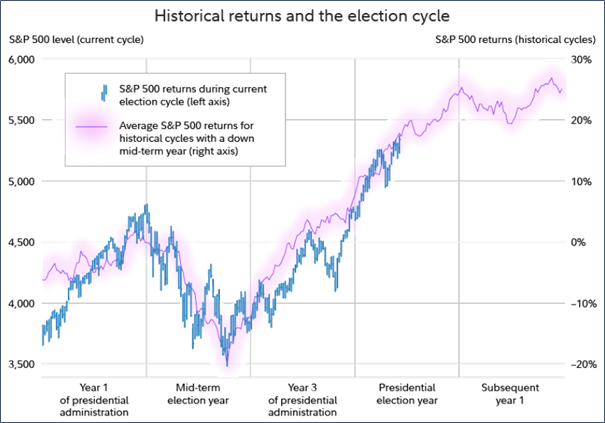

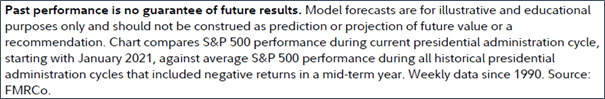

The chart below shows the average historical return of the S&P 500 (since 1990) over an election cycle where the return in the mid-term year was negative, compared to that of the current cycle.

The purple line shows the average return of the S&P 500 over the 4-year election cycle. The blue line shows the return during the current cycle.

We can see that historically the market has had a positive return in the second half of an election year, but with a blip in the 3 month period prior to the election.

“So far, we’ve been tracking this fourth-year pattern very closely. If we continue to do so, that might suggest that the bull market could continue for the remainder of this year.”

Jurrien Timmer, Director of Global Macro for Fidelity

One needs to remember that the chart shows an average, and therefore the actual performance is likely to differ. Investors should also be mindful that investment outcomes over such a short period could be considered as random. The message to investors is to expect a bumpy return from global equities as we get closer to the election.

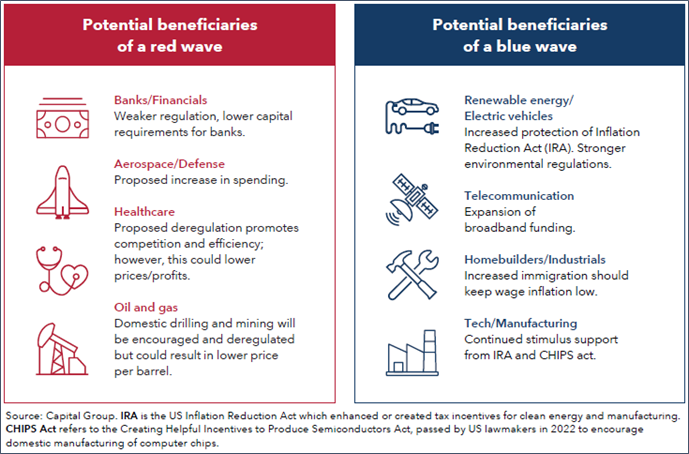

The snapshot below summarises sectors of the US economy that could do well under a red wave scenario (Republican) as well as a blue wave scenario (Democrat). This would entail the Democrat or Republican party holding a majority in both US Senate and the House of Representatives. Under such as scenario, different sectors of the economy would benefit accordingly.

Speculation could see capital flowing in and out of various sectors over the next few months in anticipation of a Trump/Biden victory as well as speculation around which party would hold a majority in the Senate and the House of Representatives.

It’s important to note that investment decisions should be based on longer‑term fundamentals, not near‑term political outcomes.

“The historical data suggests that economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns.”

U.S. Bank

Inflation levels are falling around the world whilst corporate earnings are expected to increase by double digits in both the US and emerging markets in 2024 and 2025. Around the world interest rates are also falling which is supportive of corporate earnings and the economy. The US is expected to cut interest rates before the end of the year.

In light of the above, the idea of a Trump presidency is still a major source of anxiety for many investors. Keep in mind that a Trump presidency is still the most likely outcome.

During the Fundsmith Annual Shareholder Meeting, when asked about the impact of Trump presidency in 2024, the response from Terry Smith, CEO & CIO of Fundsmith, was “not much impact at all”. This is in reference to the fact that despite Trump’s aggressive stance on China, Mexico, the middle east, climate change, trade agreements, NATO etc. world equities continued to go up over the course of his 4-year term.

Some domestic sectors as well as countries such as China may have been disadvantaged by Trump’s policies during his tenure, but as Warren Buffet has stated, the role of the US president is to avoid getting into a nuclear confrontation. Other than that, the American tailwind will survive.

The same could be said for Biden. Despite record debt and inflation numbers, a war in Europe with a global supply chain crisis, world equities continued to rise.

Regardless of who sits in the white house come January, investors must be cognisant of not falling prey to the noise or rhetoric that follows particularly in the case of a Trump presidency.

FORWARD OUTLOOK (OFFSHORE)

The outlook for markets remains positive. Historical data suggests that volatility increases in the 3-month period prior to the US election. The noisy rhetoric and mudslinging between democrats and republicans has already begun. Not to mention between the candidates as well.

We are reminded that according to historical data, economic and inflation trends rather than election outcomes, tend to have a stronger and more consistent relationship with market returns. Regardless of the outcome of the election, economic fundamentals and corporate earning will influence the course and direction of markets.

Although we still have several months before the America populous take to the polls, Trump appears to be the most probable candidate for the presidency. After his first presidential term, the world is now well versed in Trump’s stance towards foreign policy. An increase in geopolitical tension may be a natural course of events over the coming months, if not years.

Inflation both in the US and around the world is expected to continue to moderate as we get closer to the first interest rate cut, which is now expected to take place in September.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.