2025 FIRST QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

The South African stock market declined -2.2% over the fourth quarter of 2024. Resources fell -7.9% whilst financials retraced -1.3% over the quarter. Local South African centric stocks, commonly referred to as “SA Inc stocks” rose modestly by 1%. The local bond market also had a positive quarter, up 1.3%.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2015/01/01 – 2024/12/31)

Source: Tradingeconomics

Over the quarter we saw a shift in the expected number of interest rate cuts in 2025. This comes despite the fact that inflation in South Africa is within scope for the reserve bank to lower interest rates. Some economists now expect between 0.25% – 0.50% reduction in interest rates over the course of 2025. A far cry from the previous expectation of 1%. Economist Dawie Roodt expects a 0.75% reduction in the interest rate over the course of 2025.

SARB Governor Lesetja Kganyago warned that although pricing pressures have eased, Donald Trump’s re-election poses risks to inflation in South Africa and therefore threatens the potential for further interest rate cuts in South Africa.

The rand weakened against the USD by 8.4% over the quarter, negating much of the strength that was seen in the previous quarter. On the other hand, the rand weakened by only 1.9% against the pound.

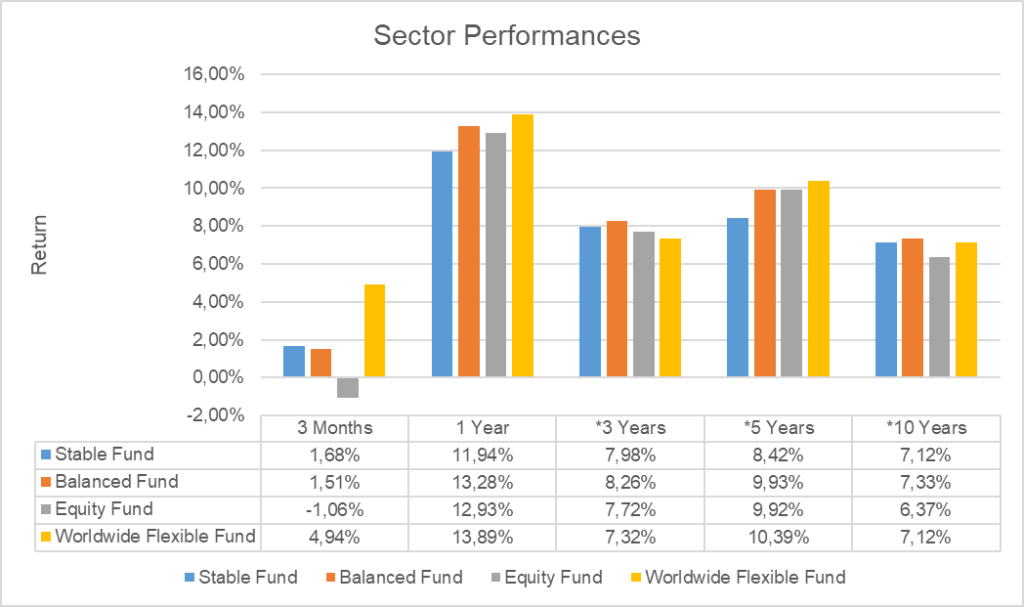

Source: Profile Data 31/12/2024

* Annualised Performance

OUTLOOK (LOCAL)

South African GDP is expected to come in at less than 1% for 2024. No surprises there. The outlook for 2025 is meaningfully better at a consensus of 1.5%. Although 1.5% GDP growth is still disappointing, it’s a step in the right direction. In reality South Africa needs to do better than this if we are to stabilise our debt-to-GDP as well as tackling issues such as mass unemployment.

South Africa is expected to continue to cut interest rates, however, the number of expected interest rate cuts is in question with most economists expecting less cuts than before.

The number of interest rate cuts will likely be dependent on external factors such as interest rate cuts in the US, and the impact of Trump 2.0 on global growth, inflation and trade relations.

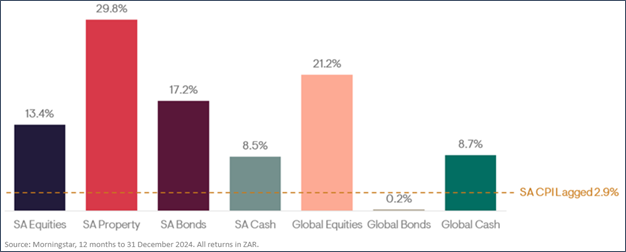

Select South African assets continue to exhibit the potential for attractive returns as interest rates fall and economic activity accelerates. South African assets performed well in 2024 as shown in the chart below.

Despite the opportunity set, the risk inherent in South African assets is increasing as the Trump administration takes office later this month. Although one would prefer to take a glass half full approach, the impact of trade tariffs, heightened geopolitical risk and potentially lower global growth may weigh on South African asset prices, the economy and the currency.

There is considerable potential for local market movements to be driven, at least in the short term, by external factors such as policy decisions in the US.

Investors should expect 2025 to be significantly more volatility than 2024.

OFFSHORE MARKETS IN A NUTSHELL

Global equity markets were relatively flat over the last quarter of 2024. The MSCI world equity index fell -0.1% in US dollars over the quarter. The world equity index underperformed the broad US market which gained 2.8% over the quarter. Emerging markets were down -7.8% however, with large cap Chinese equities only fell -6.7% after their meteoric rise in the previous quarter.

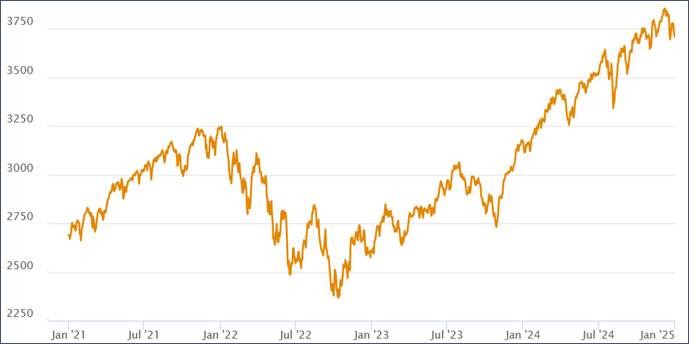

The graph below represents the World Equity Index over the last 4 years in US dollar terms.

*Performance as of 31/12/2024

A Global Review of 2024

The 2024 First Quarter Commentary highlighted the consensus view that 2024 should be a positive year for global assets prices as the US in particular, appeared to be headed for a “soft landing”. A term which refers to a slowdown in economic growth without falling into a recession.

Below, we list 4 key consensus takeaways from our 2024 First Quarter Commentary.

- The US appears to be headed for a “soft landing”.

- Growth in corporate earnings was expected to accelerate, which would develop positively for stocks.

- A continued increase in global liquidity was also expected with interest rates set to fall across the world.

- Heightened volatility as a result of the various elections taking place around the world. Most notably in the US.

In hindsight the key consensus takeaways which are highlighted above, all came to fruition over the course of the year.

The risks to this consensus view include the following:

- A resurgence in inflation resulting in further interest rate hikes which would have a negative impact on asset prices.

- Geopolitical tension.

- Election surprises.

- China fails to stimulate their economy with supportive policy measures.

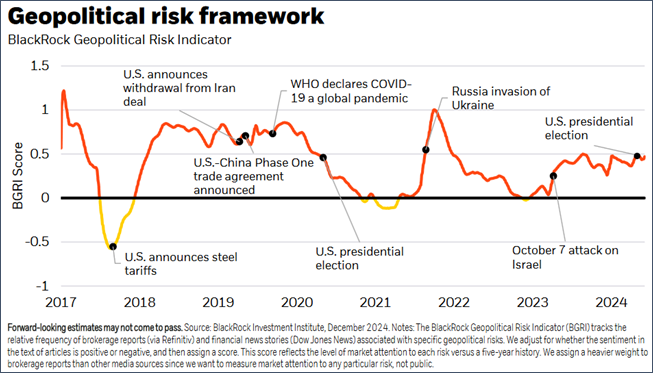

Thankfully there were no major election surprises and overall geopolitical tensions remained benign, albeit elevated compared to historical averages. There were no surprises to inflation in most of the major economies.

China is a notable disappointment over the course of the year. Despite the fact that they initiated some stimulus support packages over the course of the year, the market expected more fiscal or monetary support – support that would help to boost their economy. Towards the end of the year the threat of a Trump presidency weighed heavily on Chinese asset prices.

As we look towards the expectations for 2025, we are reminded of the heightened geopolitical risk that has been building over the past 2 years, as shown in the chart below.

Setting Clear Expectations for 2025

Setting a clear expectation for 2025 is challenging given the unmanageable nature of President Elect Trump who will shortly take the wheel from a sleepy and incoherent President Biden.

Divorcing sentiment from fundamentals will be very important in 2025.

Regardless of how one feels about Trump, his unorthodox strategic leadership approach is largely authoritarian in nature which can often be divisive and disruptive. Markets are reactive to shifts in sentiment and with a character like Trump at the helm, heightened uncertainty and volatility are a likely reality over the course of his presidential term.

The quote below highlights how uncertain the Trump effect is and its unlikely to change over the next 4 years.

With the Trump effect in motion before he has even been inaugurated, the threat of tariffs on Canada, the US’s largest trading partner and long-term ally, has in part led to the resignation of the Canadian prime minister.

With the Republicans now holding both the US Senate and House of Representatives (the legislative branches of government), Trump will be in a better position to push his political agenda in his second term. Something he lacked in the latter half of his first presidency.

Recently market commentators have expressed a shared narrative that the electioneering and provocative geopolitical rhetoric that we have seen from Trump and his campaign over recent months, is part of a larger strategy to place the US in a more favourable position going into negotiations. The rhetoric has helped to bid up US bond yields as well as the US dollar.

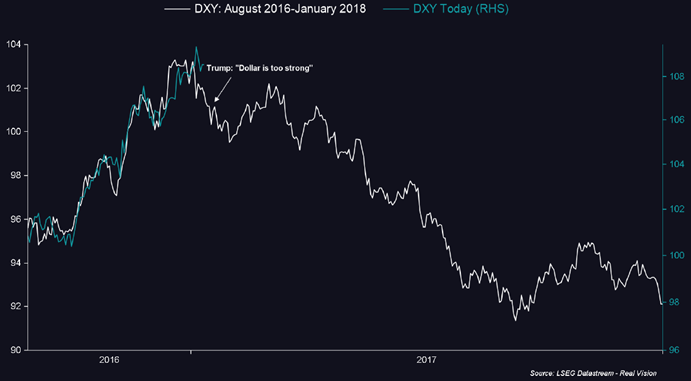

The chart below compares the performance of the US dollar index in the build up to the 2016 US election (shown by the white line) compared to where it is today.

A similar trend is being observed to that which took place in in the build up to the first Trump presidency.

In Trump’s 1987 book “The Art of the Deal”, he sheds light on his views as it relates to power, influence and of course deal making.

This approach creates uncertainty which makes investors uncomfortable and fuels the sale of risk assets which are in many investors’ portfolios. In other words, expect volatility going forward.

From a fundamental perspective, the expectation for a weaker dollar and an easing of global financial conditions will be positive for both the US and the world.

Asset prices are likely to reflect the disruptive nature of a Trump presidency. However, the consensus view is for a positive year supported by an increase in global liquidity buoyed by a weaker US dollar. This would be good for risk assets.

The risks to this consensus view include the following:

- Geopolitical tension and ensuing trade wars. This includes US and EU divergence and of course the US and China.

- A meaningful resurgence in inflation resulting in further interest rate hikes which would have a negative impact on asset prices.

- A sustained strong US dollar.

FORWARD OUTLOOK (OFFSHORE)

One should expect not only a volatile 2025, but rather a volatile Trump administration as the Trump 2.0 effect comes into play.

Sentiment arguably drives markets in the short term. The extreme 2020 Covid 19 collapse is a great example of this. With the Trump campaign proposing a widespread tariff to fund large tax cuts in the US, sentiment is likely to shift on a regular basis.

Trade wars between the US and China seem all but inevitable at this point which has already seen Chinese asset prices fall. Ongoing tension between the two superpowers may become a bit like the war in Ukraine, protracted, chaotic and directionless. But nevertheless, disruptive on a global scale.

On the positive side, macro-economic factors would suggest that 2025 could be a positive year for growth assets, particularly in the US.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.