2025 SECOND QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

The South African stock market gained 5.9% over the quarter. Resources were up 15.8% whilst financials retraced -1.8%. Local South African centric stocks, commonly referred to as “SA Inc stocks” fell 6.4%. The local bond market also had a positive quarter, up 0.7%.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2015/04/01 – 2025/03/30)

Source: Tradingeconomics

It’s been an eventful quarter for South Africa for all the wrong reasons.

In February Trump spoke out against South Africa’s policies such as land expropriation without compensation and other “human rights violations” as well as its ties to Iran and political views against Israel. The Trump administration has also established a plan to “resettle disfavoured minorities in South Africa discriminated against because of their race as refugees”.

In March South African ambassador to the US Ebrahim Rasool was expelled from the US for comments that he made in a public forum implying that Trump is a white supremacist.

Meanwhile the South African budget was postponed on the day of the budget speech due to disagreement by the various parties. The budget speech was revised, presented in March and approved by a 52% majority.

Conflicts within the GNU is evident and all over the media with some suggesting a possible cabinet reshuffle or even the possibility that the DA be removed from the GNU.

On the 2nd of April Trump announced a 30% tariff on US imports from South Africa. Some market commentators have suggested that the AGOA trade agreement which is set to expire at the end of September is unlikely to be renewed.

Given the events that have unfolded thus far in 2025, we are reminded of the quote by Vladimir Ilyich Lenin “There are decades where nothing happens; and there are weeks where decades happen”.

The rand weakened against the USD by 2.9% over the quarter, while on the other hand, the rand strengthened by 0.6% against the pound.

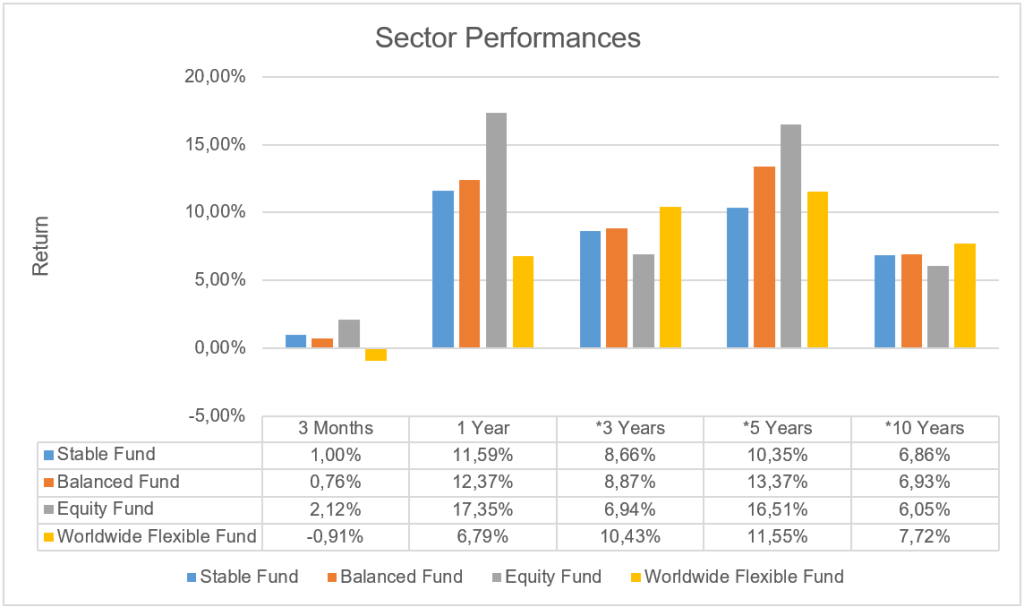

Source: Profile Data 30/03/2025

* Annualised Performance

Heading For Disaster

It seems as though much has changed in such a short period. We have written on numerous occasions over the years that in the absence of structural reform, South Africa potentially faces more of the same – deteriorating financial and economic fundamentals.

The stance taken by the South African government to increase taxes and abandon the cutting of government expenditure will severely affect the country at a time when we are in desperate need of meaningful reform.

The finance minister’s comments with regards to cutting government expenditure was that “spending cuts were not effective, now we look to higher tax revenue”. Despite the evidence that we cannot tax our way out of the situation that we now find ourselves in, this is the view of our finance minister – supported by the ANC.

Despite the fact that we spend copious amounts of money on budget items such as education, economist Dawie Roodt reminds us that “for example, the country spends hundreds of billions of rands on education—the largest budget item—yet has some of the poorest quality education in the world, often ranking among the lowest, if not the lowest, in various international tests”.

Dawie Roodt as well as Nedbank Chief Economist Nicky Weimar unpacked the budget in separate webinars both concluding that despite the tax hike, we are unlikely to grow by as much as treasury’s forecast nor are we likely to limit our spending to what has been proposed in the budget.

Both economists expecting that we will likely be in a similar or worse financial position next year. However, that was before the Trump administration implemented a 30% tariff on South Africa.

Its arguable that until we see meaningful structural reform being implemented in South Africa, that the risk for deteriorating financial and economic fundamentals remains high and is likely a base case scenario.

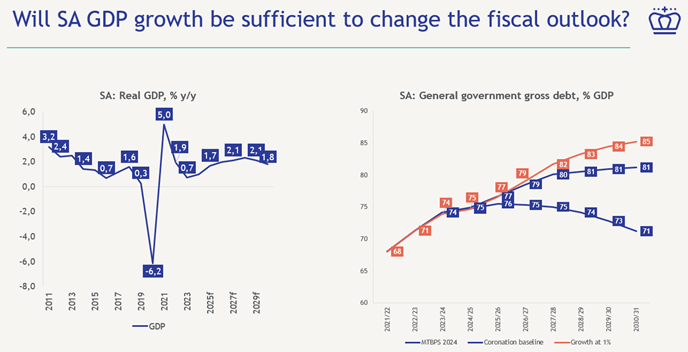

The chart below (compiled by Coronation Asset Management before the negative events over the last month) shows the lacklustre growth expectations over the coming years which are now expected to be even lower.

South Africa needs to be growing at an average of 3% per year to stave off an economic and financial disaster. As the analysts and economists remind us, a 3% GDP target is nearly impossible without structural reform which has not materialised and does not appear to be on the cards under the ANC led Government of National Unity or GNU.

The consequence of this policy stance and economic reality is shown in the chart on the right. It shows that South Africa’s debt to GDP will continue to deteriorate well beyond what the government is forecasting. This means, less money for government to run the country as they pay more in interest costs to fund our debt, less foreign investment in the country, less capital investment in infrastructure, more taxes and so on..

For the time being it seems as though South Africa is unwilling to take the necessary steps to mend our diplomatic relationship with the US, whist the ANC pushes through controversial policies such as the Bela Act, Expropriation Without Compensation as well increasing taxes on an already weak consumer base.

What is one to conclude about all of this?

Investors are right to be concerned with the path that South Africa has set itself on. Though times lie ahead over the next 5 – 10 years with the likes of economist Dawie Roodt warning that South Africa could be headed for a recession.

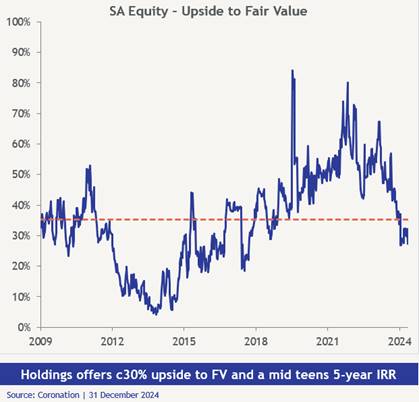

The chart below shows Coronation’s SA equity upside to fair value in the equities that they hold. It shows an average of 30% upside to fair value which they equate to a double digit per annum return over a 5 year period. Given the recent market fall, the upside to fair value is likely meaningfully higher.

This suggests that there is value in select local equities, and the same could be said for South African bonds. Coronation suggests that a measured approach is necessary when navigating South African assets given the upside to risk.

Asset managers are well positioned to navigate the challenges and opportunities that lie ahead for South Africa asset prices. A diversified portfolio consisting of several highly rated asset managers can provide reassurance for investors during uncertain times.

OUTLOOK (LOCAL)

The long-term outlook for South Africa, economically and financially is worrying. We are likely to see continued economic and financial deterioration over the coming years.

Tensions within the GNU have compounded the negative sentiment around the country. Although conflict was always to be expected within the GNU, it seems to be perched on a knife’s edge. The ANC continues to push its agenda, as evident by the budget debacle with disregard for structural reform as well as its partners within the GNU. This has been largely reflected in both the local currency as well as South African centric stocks.

Globally, the world waits to see the outcome of Trump’s trade wars, with concerns that they could plunge the world into a recession. Although this is certainly not the base case. If the trade war relates to lower global growth, which is the base case, with second round effects related to poor trade between South Africa and the US, we could be headed for a difficult period of low to negative growth in the country. A possible recession as warned by economist Dawie Roodt.

Given these ongoing issues, South Africans should expect more volatility over the period head.

Although there is value in select local asset classes, Coronation suggests that a measured approach is necessary when navigating these assets given the upside to risk.

So, whilst there is broad consensus that there are material problems ahead for South Africa, there is every reason to be positive that well-constructed global portfolios will be well-protected financially from many of the issues discussed.

At times such as this, its important to keep a level head and for one to reaffirm their commitment to their financial plan which helps to guide decisions when fear and uncertainty are widespread.

OFFSHORE MARKETS IN A NUTSHELL

Global equity markets were negative over the quarter. The MSCI world equity index fell -1.8% in US dollars. The world equity index outperformed the broad US market which fell -4.6% over the quarter. Emerging markets were up 2.9% buoyed by large cap Chinese equities which soared 15% over the quarter. The UK also experienced a meaningful recovery of 9.7% in dollar terms and a lesser 6.4% in pounds.

The graph below represents the World Equity Index over the last 4 years in US dollar terms.

*Performance as of 30/03/2025

The famed Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) fell -15.8% over the quarter dragging down global indices and the S&P 500.

Geopolitical tensions ran high with numerous actions being taken and statements being made by President Trump and the Trump administration. These include implementation of tariffs on various countries as well as provocative statements.

Trump has proposed that the US “take over” Gaza, secure control of Greenland and the Panama Canal as a matter of national security as well as establishing Canada as the US’s 51st state. Although none of this seems possible, the world watches in awe and disbelief.

Tensions rose between the US, Ukraine and Europe over the war in Ukraine with Trump withholding military aid to Ukraine in an effort to establish a cease-fire. Despite the Trump administration’s actions, the efforts to negotiate a cease-fire has failed so far, and the war rages on.

Trumps latest announcement on the 2nd of April to tariff more than 100 countries has sent global markets into turmoil with the media touting recessionary headlines.

A week into April, and it already feels like the first quarter is old news.

The Art of the Deal Trade War:

It’s been an eventful, but otherwise benign quarter for markets. During the course of February and March, the US imposed tariffs on China, Canada and Mexico. With threats to tariff other countries as well as the EU – the largest single importer of US goods.

On the 2nd of April, Trump unleashed chaos with an announcement that the US will tariff over 100 countries as well as select goods and commodities. This applies to both the US’s closest allies as well as its foes.

It was a clear risk going into 2025 and one that market didn’t expect would materialise to such an extent.

Markets have reacted with extreme fear given the degree of uncertainty. A reaction similar to that of the Covid Crash of early 2020. A time where many investors fled from the market in mass fear.

The concern is that the tariffs in their current form, are unsustainable and could drive the world (including the US) into a recession. The other issue is that of reciprocal tariffs and other countermeasures that would be used to fight the US’s tariff war.

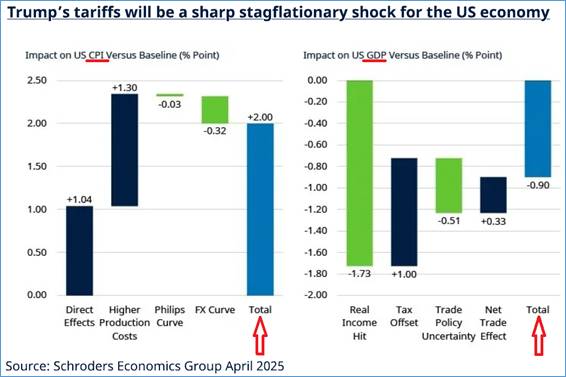

The chart below attempts to factor in the increase that these tariffs will have on US inflation which Schroders expects could increase by around 2% as well as US economic growth (GDP) which they expect to fall by around -0.9%.

Countries such as China and Canada have already responded with reciprocal tariffs with others vowing to “fight” Trump’s latest round of tariffs. This creates further uncertainty which fuels more fear.

With emotions running high, investors are anxious to understand the implications of what’s unfolding.

The general view is that this is likely to be part of Trump’s strategy to force countries to renegotiate their trade policies with the US.

Others such as State Street have referred to the announcement as “maximum tariffs with room for negotiation”.

This is evident by the recent comments by the European Commission President that “Europe is always ready for a good deal,” and that they “prefer to have a negotiated solution, but we are also prepared to respond through countermeasures and defend our interests”.

As uncomfortable as Trump’s ‘shock and awe’ approach maybe, the US needs a deal just as much as the rest of the world needs relief from US tariffs.

Various economists expect further developments around bilateral negotiations and trade agreements in the coming weeks and months.

As mentioned in our previous quarterly commentary “[Trump’s] approach creates uncertainty which makes investors uncomfortable and fuels the sale of risk assets which are in many investors’ portfolios. In other words, expect volatility going forward. From a fundamental perspective, the expectation for a weaker dollar and an easing of global financial conditions will be positive for both the US and the world.”

When one looks at the fundamentals, the dollar has continued to weaken whilst global liquidity has continued to rise. Leading indicators also suggest that financial conditions continue to ease which is good for global markets.

Julien Bittel, head of Global Macro at GMI, suggests that as at the time of writing extreme fear has been largely priced into markets. In other words, the fear is already in the price.

The chart below shows Coronation’s global equity upside to fair value in the equities that they hold. It shows an average of 50% upside to fair value which they equate to a double digit per annum return over a 5 year period. Given the recent market fall, the upside to fair value is likely to be meaningfully higher.

We continue to expect heightened noise over the coming months, whilst countries are forced to the negotiating table and trade agreements are ironed out.

Given the upside to fair value in global equities, coupled with improving macroeconomics (weaker dollar, lower interest rates, lower commodity prices and increased global liquidity) investors must remain committed to their financial plan and avoid any knee jerk reactions which are driven by fear and are probably already discounted in the price of their investments.

FORWARD OUTLOOK (OFFSHORE)

We continue to expect heightened noise (volatility) over the coming months, whilst countries are forced to the negotiating table and trade agreements are ironed out.

Investors are reminded that the US needs better trade deals just as much as the rest of the world needs relief from US tariffs.

A drawn-out trade war with China is of particular concern to market strategists. It is however, in neither country’s interest to prolong such a conflict.

Fears around a recession either globally or in the US, are thus far overlooking the fact that the causal factors are policy based and can be replaced through a shift in policy.

It’s critical that investors remember that long-term wealth creation has always required staying the course through periods of short-term disruption. Staying invested, diversified, and focused on long-term objectives remains the most reliable path to building and preserving wealth.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.