What to believe? A balanced view on Sean Peche’s message.

What to believe? A balanced view on Sean Peche’s message.

Size

Size does matter however, this needs to be clarified. In a bull market, size is less important than it is when markets are trading sideways. In other words, size in particular, comes more into play during parts of the market cycle. Locally size has been an important factor over the past 3 – 5 years. In the previous 3 – 5 years it was less relevant.

Smaller managers don’t tend to have the same resources as the larger managers have. This is particularly relevant when it comes to managing offshore assets. Smaller boutique managers tend to have limitations in their offshore management capacity due to less analysts and depth of research. The size argument is mostly relevant within the local asset space. It’s less relevant in the global landscape as the investment options are far greater and more liquid when compared to local assets.

Large asset managers in South Africa have greater limitations within the local asset space due to their size. Having said that, this does not warrant overlooking them. With the new regulation 28 limits, local balanced funds can take up to 45% of their assets offshore. This may play into the hands of the larger asset managers over the next decade.

Fees

Fees have and will always be a controversial topic. It’s a very complicated topic and one that the API

team have discussed at length. The fees that are charged by local asset managers is arguably too high. Most fund managers shouldn’t be charging much more than 1% + vat. The smaller managers tend to have high fees due to the fact that they trade more frequently (this is due to their size) which increases the transaction costs as well have having a lower scalability than the larger managers.

The Allan Gray Stable Fund has a benchmark of cash +2%. Anything over and above this, they charge

a performance fee. The fund targets a return of inflation +3% as do most multi-asset stable funds.

Therefore, the benchmark for this fund is perhaps questionable. We nevertheless continue to use the fund because we have faith in the manager’s ability to generate attractive long-term return after all fees.

The Allan Gray Stable Fund has meaningfully outperformed the sector average over 1, 3 and 5 years

on an after-fee basis.

When it comes to fees the bottom line is that the fund needs to produce a real return (net of inflation and all costs) and that performance needs to be competitive when compared to any and all alternative funds or strategies that carry a similar risk profile.

Performance fees are extremely controversial. Simply put, performance fees should incentivise the manager to perform over and above their benchmark. The controversial issue around performance fees typically relates to the benchmark itself. As discussed, benchmarks should be relevant, and should demand a high standard of performance to meet before any “performance fees” are levied. In the absence of these two elements, they are likely to always be easy targets of criticism and contention.

We expect fees will come down over the next 5 – 10 years. We have already seen it happening. As with most things, progress never comes soon enough.

Benchmarks and performance

As discussed above, benchmarks can be very misleading. The Allan Gray Stable Fund benchmark is misleading. I agree that the balanced fund category average is not an onerous benchmark to beat when putting a portfolio together. When you look at the three largest balanced funds in South Africa, all of them have meaningfully outperformed the average fund over reasonable periods of time as one would expect them too. Beating a passive index is the tricky bit.

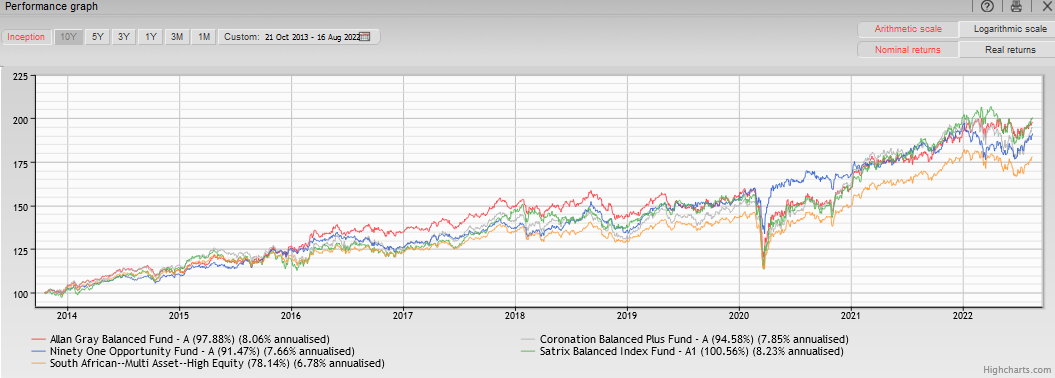

In the chart below we have compared the three largest balanced funds to the Satrix Balanced Index Fund, which is a low-cost passive index fund that comfortably outperforms the average balanced fund. We can see that the Satrix Balanced Index Fund has performed roughly in line with that of the three largest balanced funds. Both the Satrix Balanced Index Fund and the three largest balanced funds have comfortably outperformed the peer group which is represented by the orange line. On a year-to-date basis the Satrix Balanced Index Fund has outperformed the other balanced funds however, we have seen this before. It occurred in 2015 and 2018 after which it underperformed the three balanced funds. We can also see in the chart that the three balanced funds have each had their period where they have outperformed both the Satrix Balanced Index as well as one another. We would expect this over time.

Source: Allan Gray Fund Research Tool

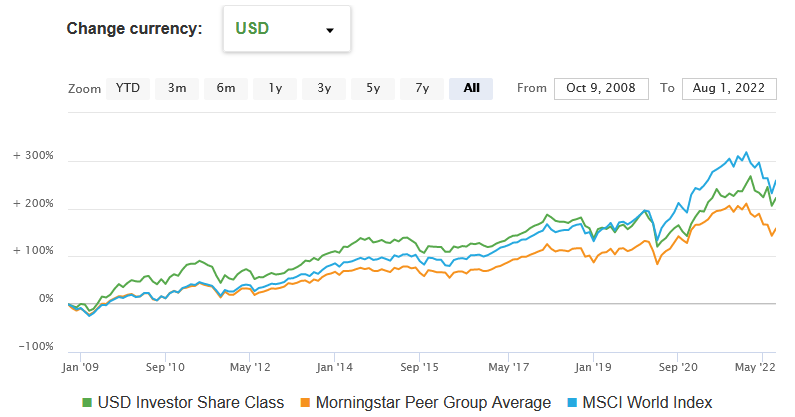

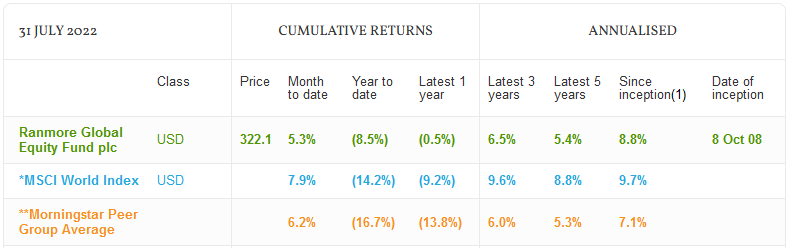

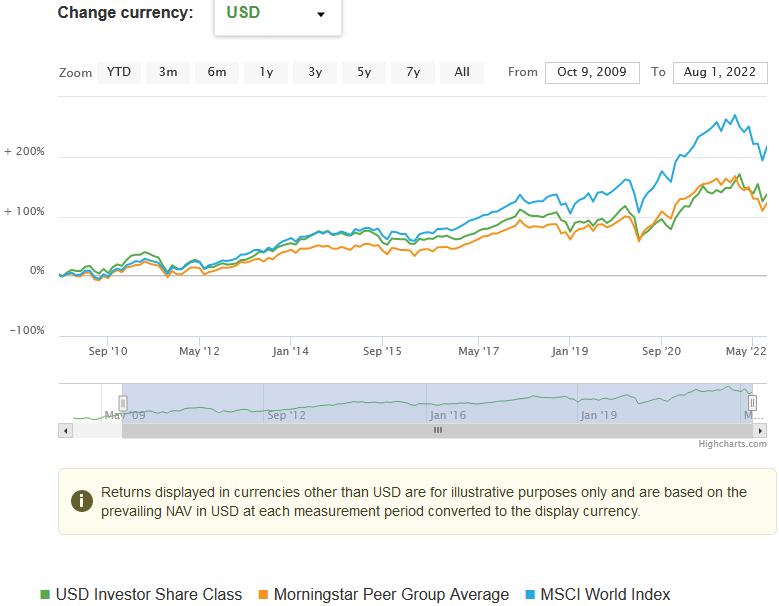

Sean Peche talks about the MSCI World as the benchmark that his global equity fund is trying to outperform. You can see from the chart and performance table below that his fund has underperformed the index or benchmark since inception however, he has outperformed the average global equity fund (Morningstar peer group average). The underperformance from the benchmark has only happened in since covid struck. 69.53% of the MSCI World Index consists of US equities which have been expensive and therefore value managers such as Ranmore (Sean Peche’s own fund) have been meaningfully underweight these assets, which has helped them over the last year.

Source: Ranmore website

Source: Ranmore website

Source: Ranmore website

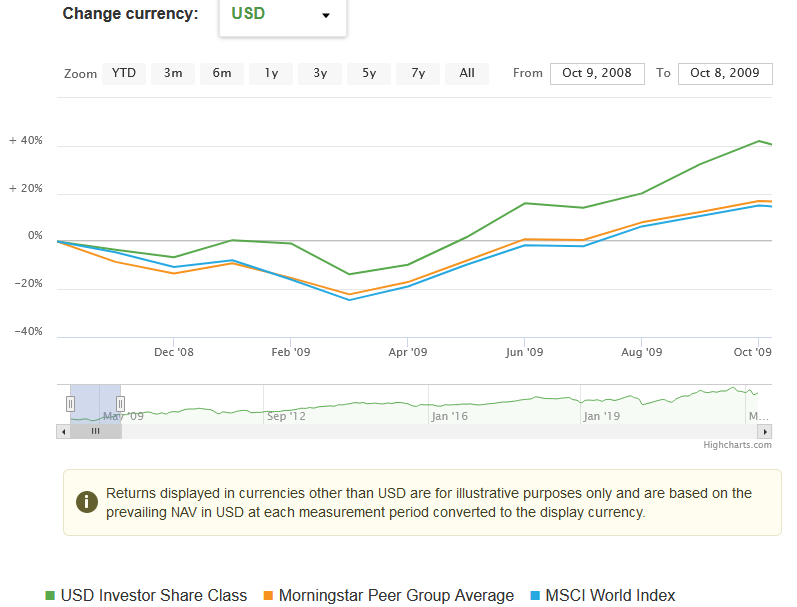

The chart below shows the performance of the Ranmore Global Equity Fund over the first year of the fund’s history. The fund return about twice that of the index which is a really great return. The fund was started in the hight of the Global Financial Crisis when many managers were being forced to unwind positions during a period where the market had little liquidity. Ranmore would have likely had the benefit of missing the worst period of the GFC. The fund was also likely to have had a positive inflow of cash whilst liquidity was drying up.

Source: Ranmore website

Source: Ranmore website

The chart below shows the performance of the fund excluding the first year. Over the almost 13 year period the fund has meaningfully underperformed the index. Sean Peche criticized the larger managers for having a great return in the earlier years whilst suggesting that they are now too big to outperform. Interesting….

Source: Ranmore website

Peche also criticizes them for charging performance fees based on outperforming the peer group average as the chosen benchmark. He instead suggests that a market related benchmark is more appropriate. In the case of the Ranmore fund, it would be the MSCI World Index which is shown by the blue line.

Investor behaviour

Sean Peche spoke about the fact that advisers pick the underlying funds and implied that if they recommend the larger managers, then what value do they add as anyone can do that. This just shows why he is a fund manager and not an adviser! One can argue that the largest area of value that a qualified, professional financial advisers adds to a client’s return, is achieved through managing the clients as much, if not more than the investments. Investors panic regardless of whether they are invested in a small manager, large manager or index fund. If they give into fear or greed its likely to hurt the performance of their investments far more than whether they invested in a small or large manager who charges performance fees. This important factor is completely overlooked by Sean.

Our preferred strategy

Our preferred strategy is to hold both small and large managers in a portfolio. This enables the various managers to leverage off of their respective strengths and provides optionality in the portfolios. We have the same opinion with regards to passive and active funds. We feel that there is room for both of them in a portfolio.

As discussed, the truth isn’t as simple as Sean Peche makes it out to be in the interview. The frustrating thing for qualified, professional financial advisers is that if one does not have the knowledge or the experience to objectively view and question the data, one could be easily swayed into believing the unbalanced views of popular media personalities such as Sean Peche.

Sean Peche’s point regarding the fees does have some validity to it as does the point that smaller manager can add value to a portfolio. We hope to see the fees within the asset management industry fall to more reasonable levels which include more appropriate benchmarks where applicable.

Instead of attacking the managers who run the largest South African balanced funds, Sean Peche would have done better to tackle the large life companies who arguably sell expensive products with penalties to exit on early termination. But this wouldn’t have helped to give him the widespread media coverage that it has.