2023 FIRST QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

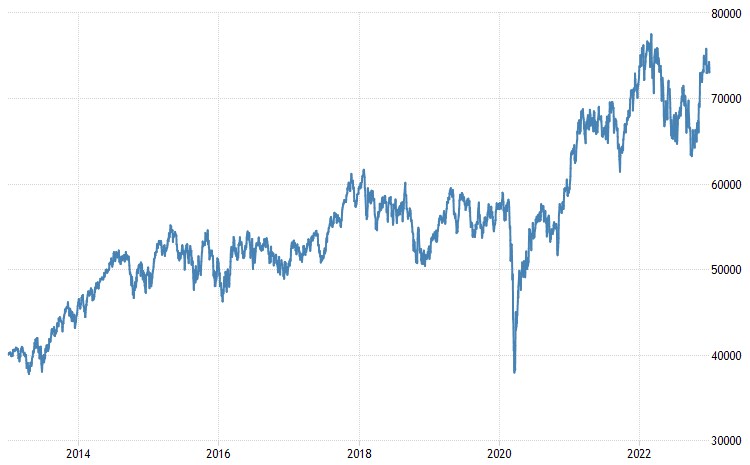

The South African stock market gained 15.16% over the fourth quarter 2022. The local stock market therefore returned 3.58% for the year. A relatively good ending to an otherwise very volatile year. It serves as a reminder of how quickly markets can recover.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2013/01/01 – 2022/12/31)

Source: Trading economics

The local stock market performance during the fourth quarter of 2022 was led not by optimism surrounding South Africa but rather a shift in global sentiment.

The ANC electoral conference saw Ramaphosa being re-elected as president of the ANC in what was a nail-biting electoral conference (given the recent Phala Phala report) which included a renewed Zuma faction with the infamous ex-president making a fit and healthy appearance – given the fact that he is a medical parolee.

Over the quarter the rand strengthened by around 6% against the US dollar. Over the course of the year the rand weakened by 6.9% against the US dollar.

The South African reserve bank continued to hike interest rates over the quarter in order to counteract rising inflation, with further rate hikes expected in the first quarter of 2023.

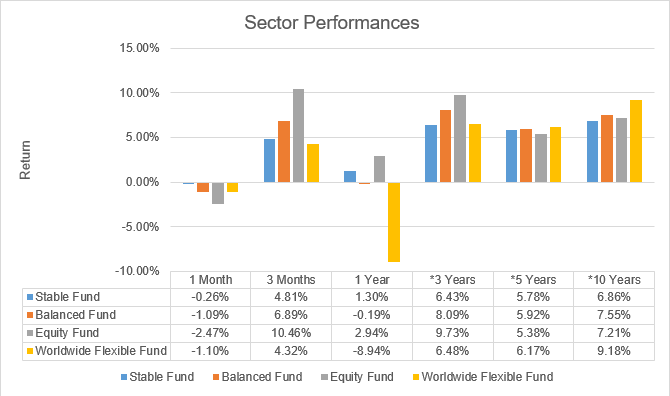

Source: Profile Data 31/12/2022

* Annualised Performance

OUTLOOK (LOCAL)

The outlook for local assets over the course of the year remains positive. This is somewhat counter-intuitive, given that economically, South Africa is expected to suffer yet another year of low GDP growth, plagued by load shedding, poor governance and further compounded by relatively high interest rates.

The big unknown is China. Why does that matter? Over the past several years the general direction of emerging markets has been influenced by China more so than local events. The consensus for 2023 is that China could benefit from a “reopening theme” which describes the fact that they could be moving into a new phase of improved economic growth. This would be very positive for both South African stocks, bonds as well as the local currency.

Although South African inflation may have peaked, decisions such as the 18.65% increase in energy are expected to continue to keep inflation high. According to the SARB’s latest forecast, headline CPI is expected to be 6.7% for 2022 and 5.4% for 2023, before easing to 4.5% in 2024.

OFFSHORE MARKETS IN A NUTSHELL

Global equity markets had a much-needed reprieve in the fourth quarter of 2022. The MSCI world equity index was up 9.83% over the quarter in US dollars.

The graph below represents the World Equity Index over 5 years in dollar terms.

*Performance as of 31/12/2022

Inflation which was a major concern during the course of the year, appears to have peaked in the fourth quarter with clear signs of falling prices in all major sectors of the US economy, with the notable exception of housing. It is however, commonly accepted that housing data tends to have a lagging effect when it comes to inflation data. This led to a more optimistic outlook for markets in 2023 as the market started to price in the idea that the US central bank may become more accommodative in its stance to raising interest rates over the course of the year.

After large scale protests, China announced an easing of its zero covid policies which added to a renewed sense of optimism. This materialised on the back of a third successful re-election for Xi Jinping as leader of the ruling Chinese Communist Party.

According to market researchers Alpine Macro, looking ahead to 2023, they believe that disinflation and economic desynchronization will be the defining macro themes that shape the investment landscape. They believe that markets will rebound as central banks slow and eventually stop their monetary tightening campaigns.

A year in review

In the 2021 Fourth Quarter Summary, we summarised several consensus views into five key themes. Namely, inflation, interest rates, lower but positive global growth, heightened risk of volatility and what to do about China.

Who would have thought that Putin would have been foolish enough to aggressively invade Ukraine, or by proxy, the West?

Who in hindsight, would have known that China would have resorted to full lockdowns which forced millions of citizens into hunger whilst tens of thousands of citizens were forced into covid detention centres which have been likened to modern day concentration camps?

Lastly, who would have believed that we would endure the fastest US interest rate hiking cycle since the early 1980s?

2022 had a heightened risk of volatility, however, the realities that came to bare were arguably far more severe than even the most pessimistic mainstream forecasts.

Its no wonder why the world may feel like it’s been violently slapped during an altercation with Will Smith at the 2022 Oscar awards ceremony.

From a return perspective, global bonds were perhaps the biggest disappointment. A typical global balanced fund would traditionally have a sizable position in global bonds which is considered to be a safer asset when compared to equities/stocks. In 2022 the JP Morgan Global Bond Index fell -17.31% whilst the global equity index fell -17.73% in US dollar terms. This meant that a defensive asset such as global bonds not only failed to reduce volatility but also contributed to a negative return for the year. According to Edward McQuarrie, an investment historian and professor emeritus at Santa Clara University, “2022 was the worst year on record for US bonds”.

One of the punitive realisations of 2022, is that much of the pain and uncertainty came as a result of decisions which were made by politicians, the world over. This leads one to wonder if the year ahead would be any different.

Let’s start with the premise that there is no concrete map to human behaviour. For this reason, one can only rely on the fundamentals which are inherent within successful investing. Our ability to reasonably predict the actions of the unreasonable, is second only to our ability to predict the future.

In other words, the only certain thing about uncertainty is that the future is always uncertain. Rather than trying to forecast the outcome of the war in Ukraine or whether China will invade Taiwan, investment professionals must focus on the fundamentals such as investing in successful companies that can increase shareholder wealth over time.

Setting clear expectations for 2023

A recession has traditionally been characterised by two consecutive quarters of negative GDP growth (economic growth). In the first and second quarter of 2022 the US posted negative GDP numbers which would suggest that the US experienced a technical recession in 2022. Despite high levels of inflation and a strong labour market. Although the National Bureau of Economic Research doesn’t believe the US fell into a recession in 2022, the reality is that one can imply that there was a technical recession. In some ways it was similar to that of 2018.

The consensus is that the US will enter a recession in 2023, along with, perhaps, the rest of the world. Where economists and investment analysis differ in their opinions, is when we will enter a recession, how deep the recession will be and how long it will last. Global markets have fallen in anticipation that economic activity must continue to fall, and hence corporate profits could be negatively affected and hence investments fall in value on the back of the recessionary fears.

The upcoming 2023 recession has been called the most anticipated recession in history.

- Will the recession be short and sharp like that of 2018 and 2020?

- Could it turn out to be a severe, long, and drawn-out recession like that of 2008 – 2009?

- Or alternatively, could it turn out to be a recessionary environment similar to that of the post-World War 2 period?

There seems to be two broad schools of thought:

The bulls (the optimists)

Believe that markets have already bottomed out (particularly the S&P 500) and that financial conditions should start to become more accommodating, particularly in the second half of 2023 which could be very positive for markets.

The bears (the pessimists)

Believe that we are heading into yet more difficult times and that markets have yet to bottom out and that inflation will be more stubborn to tame than what is currently accepted by the market.

There is a plethora of arguments in support of both a bull and bear case. So, what should investors expect for the year ahead?

Fidelity’s director of global macro, Jurrien Timmer has described 2023 as a year where markets will likely fluctuate between both a bullish (optimist) and bearish (pessimist) trend. In other words, market are likely to fluctuate during the course of the year which traditionally favours active managers.

Blackrock is the largest asset manager in the world. They are known for their exceptionally cheap passive or index tracking funds. In their latest Stock Market Monitor the asset manager notably states that active managers are in a good position to navigate the current market environment.

“Equities face risks but can provide opportunities in a new regime of higher rates and inflation. We believe the winning stocks will come from a wider range of sectors than over the previous decade, so selectivity is key –and active managers are well placed to capitalize on market volatility.” Blackrock – Stock Market Monitor

Alpine Macro (a well-respected renowned financial research provider) also believes that the recovery will be desynchronized with international stocks likely performing better than US stocks. Alpine Macro’s outlook for 2023 can be described as very bullish for 2023. They caution that there will be high levels of volatility over the course of the year, however, their guidance states that the US market performance during the first half of the year will be “flattish” before rising “decisively” in the second half of 2023.

Other global asset managers such as Schroders have also noted that there will be an increased divergence between the winners and the losers during the course of the year. Once again, supporting the narrative that active managers are best placed to navigate the next 12 months.

Key take a ways

- The US will enter a recession in 2023. We caution investors not to react to fearful headlines in the media regarding a 2023 recession.

- Most investment managers are optimistic that 2023 will be a better year for markets than 2022 with many of them expecting better returns during the second half of the year. This is particularly the case in the US.

- Active management will be key in 2023 as the recovery is likely to be desynchronized.

- Geopolitical risks remain a concern which could create significant volatility during the course of the year. One can only hope that China does not increase its hostile stance towards Taiwan.

- Emerging markets are seen as very attractively priced with China expected to benefit from its recent policy decisions.

FORWARD OUTLOOK (OFFSHORE)

The outlook for the year is heavily dependant on several factors such as inflation and geopolitics. The year is likely to be very volatile and investors therefore need to be mindful of this reality. That being said, at this point, there is a clear indication that fundamentals should improve and turn positive in the second half of the year. Although this is a short-term view, we remind investors that it’s futile to try and time markets. We rather emphasise the expectation that investors need to sit tight and allow the market cycle to enter a new bullish (optimistic) phase, like it did in 2020.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.