2023 SECOND QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

The South African stock market gained 5.2% over the first quarter of 2023.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2013/04/01 – 2023/03/31)

Source: Trading economics

January saw the local stock market rise by over 10%. Both February and March had negative returns. Giving back much of the gains from January. The market nevertheless closed the quarter with a positive return.

The rand weakened against all major currencies on the back of global news signalling a less rosy economic environment than the market had already priced in. The rand weakened by 4.6% against the US dollar and 6.4% against the pound over the quarter.

On the 24th of February, South Africa was relegated to the notorious “grey list”. Sadly, this is likely to have far reaching ramifications for the country. Before the ruling by the FATF, it was challenging enough to attract foreign investment into the troubled economy. Now that we have been grey listed, foreign companies are further discouraged from doing business in South Africa.

The International Monetary Fund revised its forecast for the South African GDP (economic expectations), downwards for 2023 to a miserable 0.2%. To put this into perspective, South Africa’s average GDP growth from 1994 to 2022 was 2.46% per year. Over the last decade this figure has been 0.91% per year. Needless to say, the outlook for the economy remains grim.

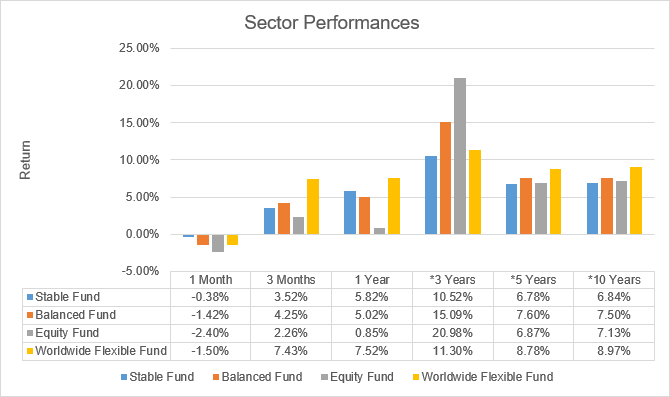

Source: Profile Data 31/03/2023

* Annualised Performance

Beware Misleading T&C of Fixed Deposits

The last time South Africa experienced interest rates this high, was 2009. Naturally, this appeals to investors who are looking for consistency and certainty in returns. Fixed deposits do indeed appear to be attractive, and yet the promotion of them can sometimes be very misleading.

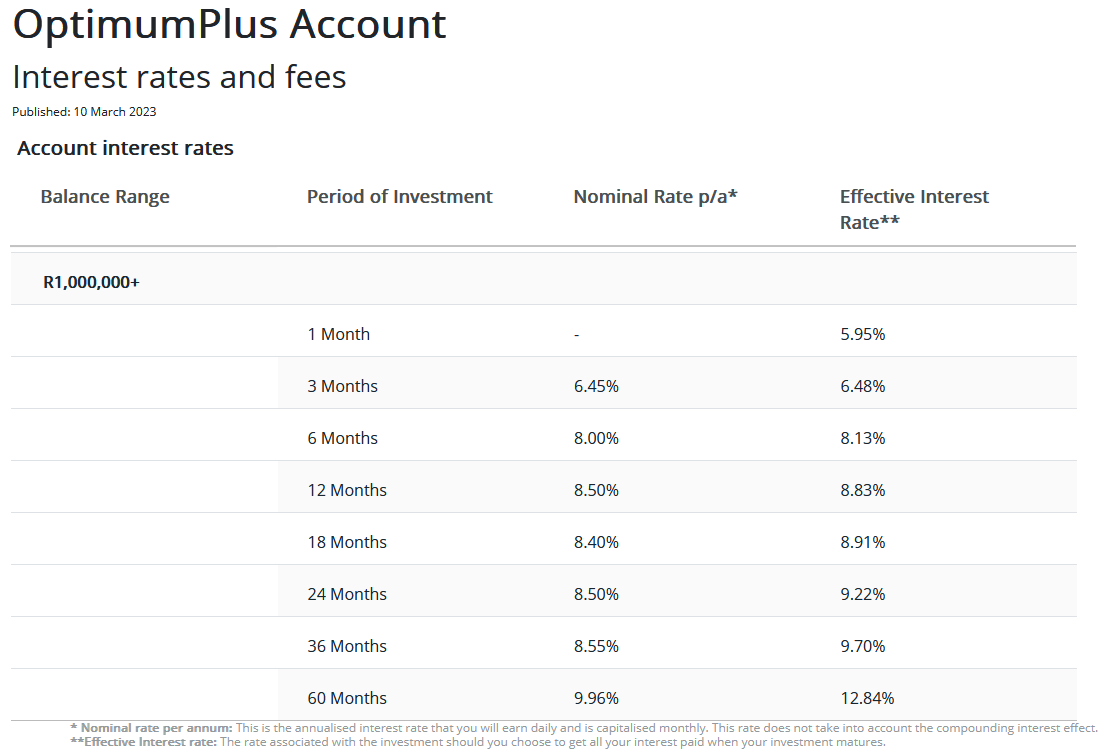

Below we discuss a popular fixed deposit that is offered by one of our well respected South African banks.

In order to qualify for this fixed deposit, you must be over 55 years of age, with a minimum investment lump sum of R1,000,000. The Effective Interest Rate over a 60-month period looks very attractive at 12.84%. But is this the compounded return that you would in fact receive?

There are two interest rates which are quoted in the table below:

The “Nominal Rate p/a” is the non-compounded, annualised interest rate which is calculated daily and is capitalised monthly. The interest is paid out at selected intervals such as monthly, quarterly, bi-annually or annually. Sounds complicated…

The “Effective Interest Rate” is the annual return in simple interest terms. The “Effective Interest Rate” is only applicable if the investor agrees to have all the interest paid out at maturity. Sounds simple, but why quote a simple interest rate rather than a compounded rate?

This begs the question, without any complicated or confusing jargon, what is the compound interest rate that an investor receives?

Based on the above, a fixed deposit period of 60-month, where the interest is paid at maturity, the compound interest rate is 10.48% per year over 5 years. This is an attractive rate, however, it is a far cry from the 12.84% which is being advertise as an “Effective Interest Rate”.

Let’s take the equation one step further.

The interest is taxable as income in the investor’s hands. It’s therefore less tax effective than capital gains tax or dividends tax.

Based on R1,000,000 invested for a 60-month period, at a compound interest rate of 10.48% the investment will generate R642,049 of interest over the 5-year period. Based on an average tax rate of 30%, the investor will be liable for R192,614 in taxable income over the period.

When factoring this into the equation, the after-tax compound interest rate is 9,07% per year.

In order to achieve this, return the investor has had to lock their capital and interest away for a 5-year period. In the case where the interest is only paid out at maturity, but accrues either monthly or annually, the taxpayer will be liable to pay the tax each year without having received a cent from the deposit. This can sometimes cause cashflow issues for investors.

Investors need to be mindful of the complicated and sometimes misleading statements which are sometimes used in the marketing of fixed deposit investments.

Not all banks are equal: Beware the risks when investing in a fixed deposit

Based on a quick internet search, the bank which seems to be offering the highest interest rate in South Africa is a bank called Access Bank SA. Access bank is a Nigerian bank which is registered in South Africa.

According to their website, Access Bank SA is offering an “Effective Interest” rate of 15.62% over a 5-year term where the interest is paid out at maturity. There is no minimum value required to access this rate. Access Bank SA is therefore offering a higher rate than that of mainstream banks such as that which is discussed above. But what are the risks involved?

Fixed deposits are guaranteed by the bank. But what happens if the bank goes into liquidation like African Bank did in 2014 or VBS Mutual Bank in 2018? Based on today’s legislation the South African Reserve Bank will only guarantee R100,000 per account in the event that a bank goes under.

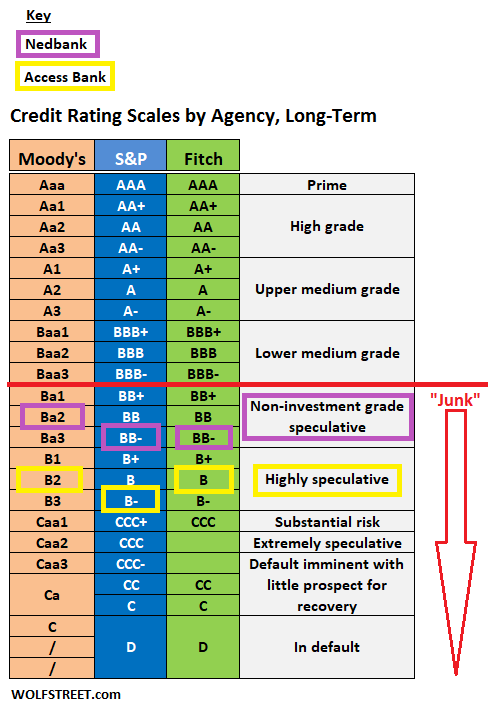

Let’s compare the credit rating of Access Bank to that of say, Nedbank. The snapshot below shows the credit ratings of the two banks according to the largest ratings agencies in the world.

Nedbank carries a long-term credit rating of “Non-Investment Grade Speculative”. This is where all South Africa’s Major banks are from a credit ratings perspective.

Access Bank has a long-term credit rating of “Highly speculative”.

Hence, although Access bank is offering a considerably higher fixed deposit rates when compared to the likes of Nedbank and others, they do not carry the same risk.

The Potential Impact of South Africa’s Grey Listing

On the 24th of February, South Africa was demoted to the to the notorious “grey list”. Sadly, this is likely to have far reaching ramifications for the country. There has been a mixed response to the potential consequences of being grey listed. Truly, there is a vast difference between South Africa’s shortfalls which were identified by the Financial Action Task Force (FATF) and our ability to rectify the issues, when compared to the likes of Syria, Yemen, Albania and Turkey who are also on the grey list.

The fact remains that the grey listing will have an impact on the local economy. The debate centres around the degree to which we will be affected.

Before the ruling by the FATF, it was challenging enough to attract foreign investment into the troubled economy. Now that we have been grey listed, foreign companies are further discouraged from doing business with South Africa. Before his departure, Andre de Ruiter warned of the possibility of a total grid collapse should the appropriate steps not be taken by Eskom to manage supply and demand over the year ahead. Energy experts have warned that South Africa could experience stage 8 loadshedding in the winter months of 2023, with some even suggesting higher stages of loadshedding. Without energy, businesses are forced to spend additional capital to address the issue of rampant loadshedding. Shoprite is potentially facing a R1.2 billion diesel bill over a 12-month period in order to run its generators, during periods of heightened loadshedding.

The question on our minds is, how attractive will it be for foreign investment in South Africa given our junk bond status, grey listing, energy crisis and all the other issues that we face? It certainly appears that the cards are stacked against us.

A study conducted by the International Monetary Fund shows that based on the data from 2000-2017, 89 countries that were grey listed experienced an average decline in capital flows equal to 7.6% of GDP over a period of nine months. The paper concludes that that grey listing has a significant negative impact on a country’s capital flows.

Against that negative context, is it all doom and gloom for the companies listed on our local stock market?

In anticipation of the decision by the FATF, Allan Gray released their comments on the subject of a possible grey listing and its consequences.

“Greylisting should not seriously impede foreign investment in South Africa. Private sector companies in South Africa are well regarded and have long-established financial links, which will continue to operate. Trade between South Africa and the rest of the world will continue, especially as the world needs South African raw materials. Legitimate investment abroad by South Africans will continue.” Sandy McGregor Allan Gray Investment Analyst and Economist

Allan Gray make the point that the rest of the world will continue to require our raw materials which requires continued foreign investment into local operations. Local private sector companies also have long-established financial links which have endured over the years where business conditions in South Africa have proved to be challenging.

Time will tell how things are likely to play out but as one can see there is likely to be a negative affect on South Africa and the local economy. There are, however, reasons why foreign investment into the private sector is likely to continue.

One can only hope that the local politicians take heed of the fact that the rest of the world is no longer going to ignore the realities of mismanagement in the country.

OUTLOOK (LOCAL)

In stark contrast to the negative outlook for the SA economy, the outlook for local investments over the course of the year is positive. Local equities are generally regarded by investment managers as cheap, and in general they have low dependence on the local economy.

Coronation Asset Management make the point that the local stock market is characterised by extremely low P/E multiples and very high dividend yields. Prices of the average stock have been hammered down to levels well below previous highs, making selected stocks “mouth-wateringly attractive”.

In the fixed income space, yields are high and as interest rates are nearing their peak, the attractiveness of these investments increases.

The reopening theme of China could also have a significant uplift on the price of local assets.

Local assets, whilst generally regarded as attractive, are nevertheless likely to remain volatile over the remainder of the year.

OFFSHORE MARKETS IN A NUTSHELL

Global equity markets continued their recovery in the first quarter of 2023. The MSCI world equity index was up 7.9% over the quarter in US dollars.

The graph below represents the World Equity Index over 5 years in dollar terms.

*Performance as of 31/03/2023

Global equity markets had a strong performance in January on the back of the momentum from the fourth quarter. In January the MSCI World Equity Index gained 7.1% whilst February had modest decline of -2.4% and March ended up 3.2%.

It was an eventful quarter, particularly in the global banking sector which saw the collapse of Silicone Valley Bank and Credit Suisse. Credit Suisse was one of the oldest financial companies in the world, having been established in 1856. As expected, interest rate hikes around the world are having a negative effect on the global economic climate.

The current macro environment is appropriately captured by the wonderful quote “No post-war expansion died of old age. They were all murdered by the Fed” (attributed to German economist Rudiger Dornbusch).

Is the world headed for a repeat of a global credit crisis?

Last quarter we wrote about the expectations for the year ahead. We cautioned that the consensus was for a recession in the US during the course of the year, and that there is risk of continued volatility as this plays out.

The first quarter of 2023 has been rather bumpy. The large shock factors over the quarter were the collapse of Silicon Valley Bank and Signature Bank in the US, as well as Credit Suisse in Europe, with many other banks feeling the systemic pressure of the tighter global environment. These failures have come about as a result of very different reasons to those which caused the collapse of the US banking sector in the 2008 Global Financial Crisis.

Silicon Valley Bank (SVB) held a significant portion of its liquid cash in US government bonds which are historically considered to be safe assets. The troubles arose because in 2020 and 2021 when US interest rates were exceptionally low, SVB had invested in long-dated government bonds which offered more attractive yields than shorter-dated ones. However, as the Fed subsequently hiked interest rates aggressively to combat inflation, so the capital values of these long-dated bonds declined.

If SVB had been able to continue to hold those bonds for the longer term, these ‘paper losses’ would not necessarily have been a problem. However, when its depositors of largely tech start-up firms came under pressure and needed their money returned, the bank was forced liquidate its long-bond positions, turning paper losses into substantial real losses (triggering them to be re-classified from ‘held to maturity’ in the bank’s accounts, to ‘mark-to-market’).

In short, it represented a misallocation of capital in regard to their potential liabilities, creating liquidity risk.

The issues leading to the collapse in Credit Suisse are different to that of Silicon Valley Bank, however, the one common denominator is that higher interest rates put the banks under pressure which revealed vulnerabilities which later led to their collapse. The pressure felt by these banks as a result of high interest rates, is echoed throughout the global banking system.

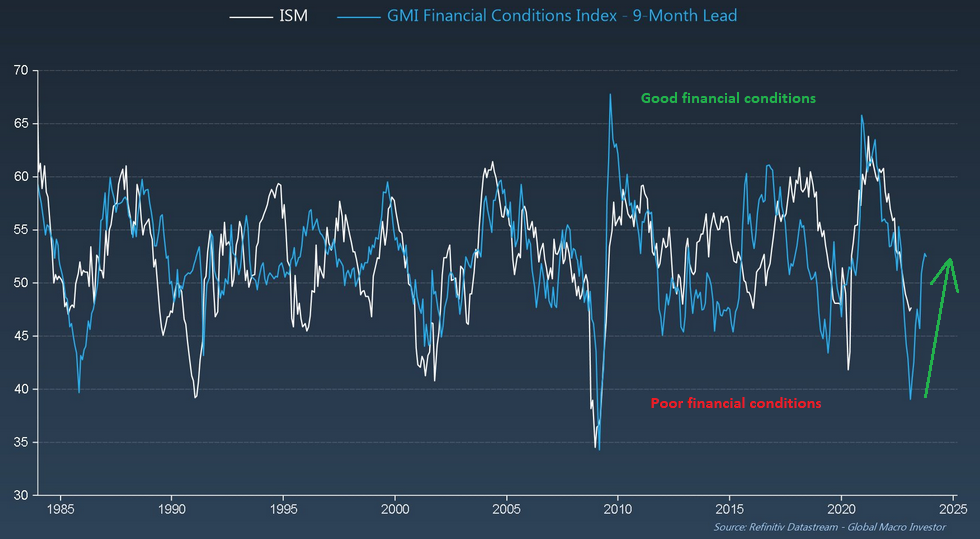

In the 2022 Second Quarter Summary we displayed a chart which is compiled by Global Macro Investor, of the GMI Global Financial Conditions Index which projected a sharp deterioration over the next 9 months. This suggested that economic activity would fall over the period. Looking back, that’s exactly what happened. Global financial conditions have deteriorated which has led to the systemic pressure in the global banking sector.

The chart below is an updated chart of the one that we showed in the 2022 Second Quarter Summary. It now shows that the GMI Global Financial Conditions Index is expected to improve meaningfully over the next 9 months.

This supports the view that central banks around the world are expected to stop hiking interest rates soon, and indeed may start lowering them by the end of the year. This would be positive for equity markets and positive for banks.

Although the issues in the global banking sector are cause for concern, the smaller lower-quality banks are likely to bear the brunt of it whilst the larger higher quality banks are less susceptible to the systemic risks. Expectations are that financial conditions ease over the course of the year, and pressure on global banks will also probably begin to ease. Until then, the risk of further smaller banks collapsing, remains elevated.

FORWARD OUTLOOK (OFFSHORE)

The outlook for the remainder of the year, continues to be heavily dependent on several factors such as inflation and geopolitics. The year is likely to continue to be very volatile and investors therefore need to be mindful of this reality.

That being said, at this point, there are clear indications that fundamentals should improve with an expectation that they will turn positive in the second half of the year. Although this is a short-term view, we remind investors that it’s futile to try and time markets. Investors need to sit tight and allow the market cycle to enter a new bullish (optimistic) phase, like it did in 2020.

Orbis (Allan Gray’s offshore parent company) make the point that it usually takes a long time and a lot of pain for bubbles to deflate and valuations to return to less exuberant levels. They remind us that from the peak of the tech bubble in 1999, it took three years for the market to hit bottom, and that it would be strange indeed if a single year (last year) completely unwound what they refer to as the biggest bubble in living memory.

They also make the point however, that valuation spreads remain exceptionally wide i.e. the fundamentally cheap stocks in the market remain unusually attractive, providing great investment opportunities, whilst the expensive stocks remain priced for exceptionally high earnings levels.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.