2024 FIRST QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

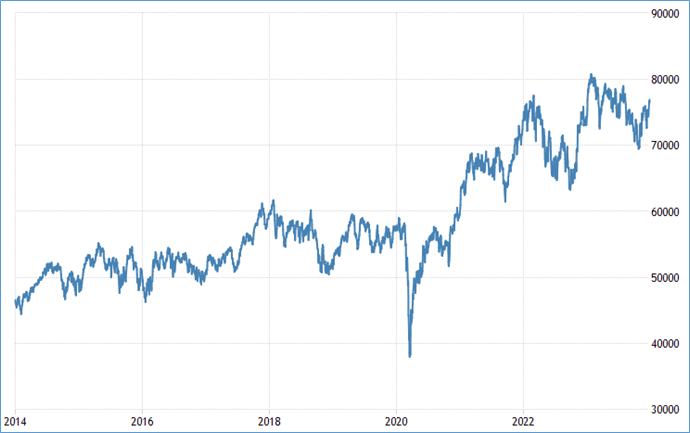

The South African stock market was up 6.92% over the fourth quarter of 2023. Resources were flat over the quarter whilst financials performed exceptionally well, delivering over 11% for the quarter.

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2014/01/01 – 2023/12/31)

Source: Trading economics

The return over the fourth quarter gave reprieve to local investors. The rally was driven by global factors which ushered in a change in sentiment.

The local market delivered 9.25% for the year. The market traded within a range of around 10% – 15% during the year. Resources had a dismal year, down over 10% after its double digit return in 2022.

In 2023, the rand weakened 7.56% against the US dollar and 13.1% against the pound. This came as no surprise after South Africa was grey list, its former state capture president was released from jail by presidential orders after two hours of incarceration, and the country experienced its worst year of load shedding and continued overall deterioration in its finances.

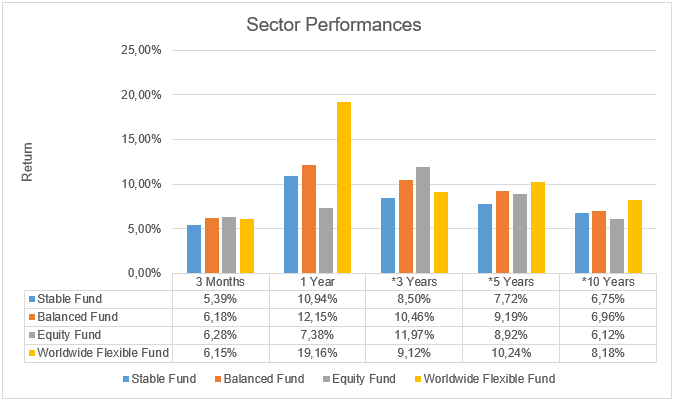

Source: Profile Data 31/12/2023

* Annualised Performance

2024 Election: The Defining Moment For Democratic South Africa And It’s Outlook

In our Fourth Quarter Commentary for 2023, we discussed the reality of a deteriorating South Africa from a fiscal, economic, and labour perspective.

One would struggle to find a fundamental case for long-term optimism regarding an improvement in the South African context. Not for a lack of South Africa’s ability to rescue itself from years of corruption and neglect, but simply because of its political realities.

Since the 2004 election, in which the ANC won almost 70% of the vote, the ruling party has since seen a decline to 57.5% in 2019. The ANC is expected to receive below 50% of the votes in 2024, which will lead to coalition governments, which global research shows often results in instability. Local municipal coalitions in hotly contested metros have already experienced this.

The 2024 election is a reminder of the 2017 ANC elective conference between Dlamini-Zuma and Ramaphosa. Despite the disastrous presidency under Ramaphosa, a Dlamini-Zuma win is believed to have been far more tyrannous outcome for the country.

How will coalition governments play out in the years to come, if that is indeed the outcome of the elections? South Africans can only wait and see.

South African economist Dawie Roodt has rightfully highlighted the danger that should the ANC experience an overwhelming loss in their majority, would they relinquish power where they are required to do so?

Regardless of the realistic possible outcomes in the upcoming election, South Africa’s challenges cannot be resolved overnight. The doomsday scenario of an ANC/EFF coalition is believed to be unlikely, but nevertheless, not off the table.

Even if the ANC retains a majority through the help of a coalition government, who could be the potential successor to Ramaphosa in the next election?

Political posturing should be expected during the course of the year. not only amongst political parties but also within political parties such as the ANC. This is likely to cause volatility in local assets as well as the rand.

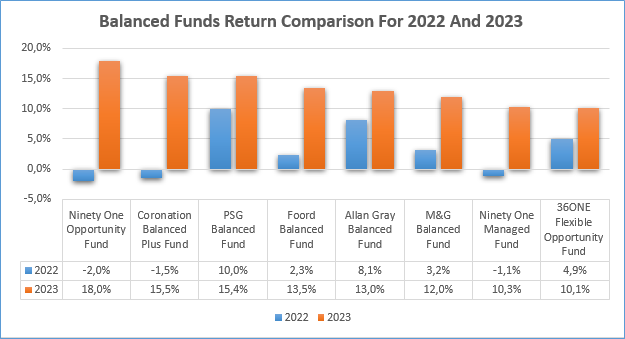

A Much Better Year For Local Balanced Funds

Local balanced funds struggled to deliver respectable returns in 2022 after having delivered great return in 2021. Thankfully 2023 was yet another year where local balanced funds performed well. The chart below shows the 2022 and 2023 calendar year returns of 8 highly rated local funds.

Ironically, of the funds shown below, the two with the worst return in 2022 have emerged as the best performing funds in 2023.

Source: Profile Data

A noteworthy difference in the funds’ asset allocation over the past 3 years, has been their increase in offshore exposure with funds such as the Ninety One Opportunity and Coronation Balanced Plus Funds holding in excess of 45% of the fund in offshore assets as of the end of September 2023.

Local managers are upbeat about the potential for another pleasing year, particularly in local balanced funds where the manager has the ability to allocate up to 45% of the fund in offshore assets.

OUTLOOK (LOCAL)

The outlook for local assets over the next 12 months is positive, subject to the outcome of the local election. South Africa is expected to have grown at around an appalling 0.5% in 2023. South Africa’s growth rate in 2024 is expected to be double that at around 1%. A lack luster expection, but nevertheless an improvement on the past year.

Corporates such as retailers, property and manufactoring companies have had to spend billions of rands on diesel generaters and renewable sources of energy such as solar in order to maintain opperations. Shoprite recorded a R1.3 billion rand diesel bill in its 2023 financial year in an effort to remain operational during loadshedding. The Foschini Group stated in May that it had lost nearly 700 000 hours of trading due to load shedding which equates to around R1.5 billion in turnover for the financial year 2023.

Load shedding is expected to improve materially in 2024 as various sources of power are expected to come back online from Kusile, Medupi, Tutuka, Majuba and Kriel. This added capacity is expected to meaningfully reduce loadshedding. The private sector has also invested heavily in renewable energy sources which have also added to the national grid whilst reducing demand. It is a trend which is expected to continue into 2024 and 2025. The overall outcome is expected to result in less frequent loadshedding which would immediately improve the profitability of companies that are enduring heavy costs accociated with loadshedding.

The South African stock market is highly correlated with the Chinese market and economy. China continues to trade at cheap prices. Although a recovery in the Chinese market was expected to take place in 2023, it has yet to happen. Global emerging market analysts suggest that the recovery has only been delayed and is now expected to take place in 2024.

A recovery in the Chinese market, coupled with a reduction in loadshedding and lower interest rates, would bode well for local assets.

Despite the positive outlook for the next 12 months, South Africa continues to face deteriorating fundamentals. A cautious approach is therefore warranted if one is to exploit the opportunities without exposing oneself to undue risk.

As mentioned earlier, the outcome of the local elections could also have a material impact on the outlook for local assets.

It is important to remember that the local stock market is not the local economy. As we continue to move forward, investment managers will continue to keep a close eye on the many issues facing our economy and position investments for the best risk-adjusted return. This may take the form of an increased allocation to offshore assets.

OFFSHORE MARKETS IN A NUTSHELL

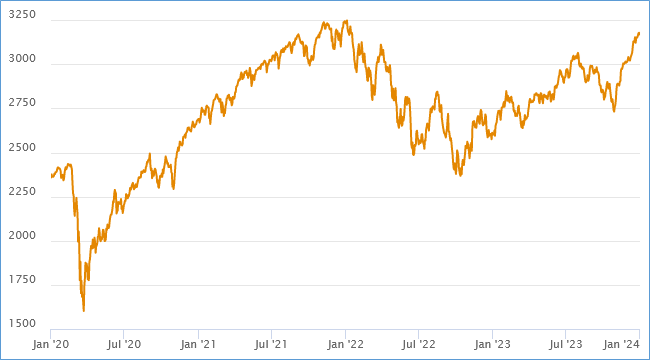

Global equity markets had a breathtaking quarter. The MSCI world equity index fell -2.88% in October whilst recovering 9.49% in November and 4.94% in December. The index closed off the quarter with an overall gain of 11.53% for the period.

The graph below represents the World Equity Index over the last 4 years in US dollar terms.

*Performance as of 31/12/2023

Over the quarter the market priced in the outcome of a “soft landing” which refers to an outcome where the world does not fall into a recession. Expectations were for a recession in 2023 which never materialised. The US economy remained robust, despite the tougher economic environment with higher interest rates.

Global bonds, as measured by the JPMorgan Government Bond Index, rallied in the fourth quarter, with a 7.8% return for the period.

In hindsight, 2023 turned out to be a rather benign year from a growth and inflation perspective, after a tumultuous 2022. Despite the recession fears, global cash levels remained at an all-time high. Investors who sat on the side line waiting for a market correction, have sadly missed out.

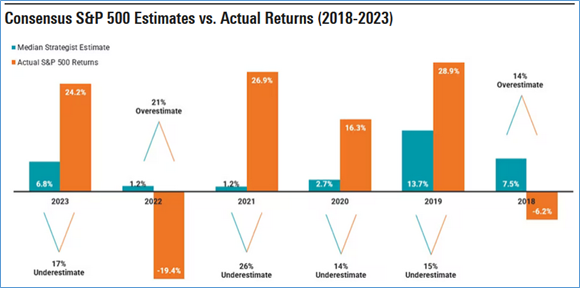

The chart below shows the consensus S&P 500 estimated returns from 23 analysts from leading investment firms against the actual performance of the index from 2018 – 2023.

Source: Morningstar

The bottom line is that in each year, the difference between the consensus expectation and the actual return differs materially. It illustrates how futile it is to try and predict short term returns in equity markets. Hence the age-old adage of being invested and staying the course rather than timing the market.

A Global Review of 2023

The 2023 First Quarter Commentary highlighted the consensus view that 2023 would be a better year for global assets, despite the fears of a global recession.

Below, we list 5 key consensus takeaways from our 2023 First Quarter Commentary.

- The US will enter a recession in 2023. We caution investors not to react to fearful headlines in the media regarding a 2023 recession.

- Most investment managers are optimistic that 2023 will be a better year for markets than 2022 with many of them expecting better returns during the second half of the year. This is particularly the case in the US.

- Active management will be key in 2023 as the recovery is likely to be desynchronized.

- Geopolitical risks remain a concern which could create significant volatility during the course of the year. One can only hope that China does not increase its hostile stance towards Taiwan.

- Emerging markets are seen as very attractively priced with China expected to benefit from its recent policy decisions.

Fortunately, the US did not enter a recession, whilst unfortunately the Chinese market continued to decline, delaying the much-anticipated recovery. Geopolitical risk ensued. Unsurprisingly, tensions between China and the US/Taiwan continued. The Israeli–Palestinian war resulted in further divide as counties declared support for one side or the other. Most importantly, 2023 was indeed a better year for global markets.

Despite the positive outcome over the year, in both bonds, equities and to some extent cash, the year was not without its ups and downs.

A regional banking crisis in the US saw the collapse of several noteworthy institutions such as Silicon Valley Bank and First Republic Bank. Further abroad, Credit Suisse’s collapse led to its acquisition by UBS which was underwritten by the Swiss government.

Fears of a declining US dollar or dollar collapse also made the rounds and has since fallen by the wayside.

US tech stocks had a stellar year, initially driven by positive sentiment around the development A.I.

A handful of mega cap US tech stocks dubbed “the magnificent 7” had disproportionate gains when compared to the rest of the S&P 500 index as well as global equities. The magnificent 7 accounted for over 62% of the performance in the S&P 500 index which had a total returned of 26.4% in USD for the year.

Two thirds of the 24.42% USD return from global equities, took place in the last quarter of 2023. By the end of October, global equities had only gained 8.34% for the year This serves as a great reminder of how one needs to stay the course rather than jumping in and out of the market.

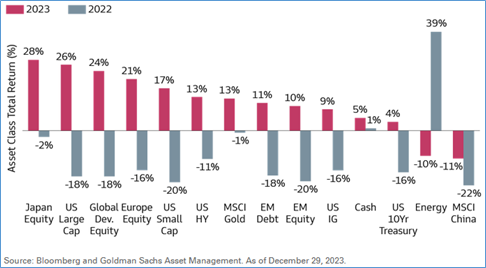

The chart below shows the asset class returns in both 2022 and 2023. The chart could almost be titled “A Mirror Image Of 2022”.

Setting clear expectations for 2024

2024 has been called “The Election Year” with over 60 countries holding government elections. This encompasses 60% of the world’s economic output and half of the world population. These include the US, Russia, Taiwan, Britain, India, Mexico as well as most of the countries within the EU.

The most important election will be that of the US, which is bound to cause volatility as politicians posture their agendas in both the democrat and republican camps.

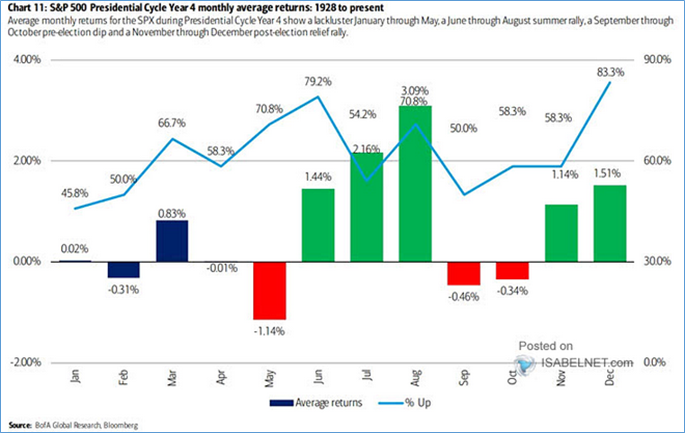

The chart below shows that based on data from 1928, during an election year in the US the S&P 500 tends to have a flat return over the first 5 months of the year. After which the returns in the third and fourth quarter turn positive.

Although the chart suggests a sluggish performance from the S&P 500 in the first part of the year, one needs to remember that the chart shows an average, and therefore the actual performance is likely to differ. Investors should also be mindful that investment outcomes over such a short period could be considered as random. The message to investors is to expect a bumpy return from global equities over the course of the year, yet again.

The consensus view for the year is that of a “soft landing” in the US, or perhaps a mild recession. Which is contrary to what was expected in 2023. Global growth in corporate earnings is expected to accelerate this year, which is positive for stocks. An increase in global liquidity is also expected to continue, which would support a continued rally in asset prices.

Interest rates around the world are expected to fall during the course of the year and emerging markets are expected to potentially outperform their developed market counterparts.

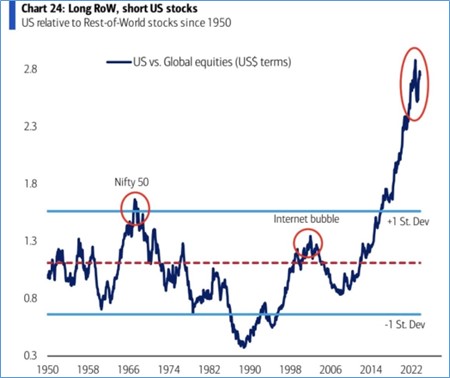

The chart below shows that relative to the rest of the world, US equities are the most expensive that they have been since 1950. This speaks to the cautious stance that many managers have towards US equities relative to other global opportunities.

In summary, 2024 is expected to be another good year for asset prices, all else being equal. That said, we have noted above how unreliable 12 month consensus forecasts are.

The risks to this consensus view include the following:

- A resurgence in inflation resulting in further interest rate hikes which would have a negative impact on asset prices.

- Geopolitical tension.

- Election surprises.

- China fails to stimulate their economy with supportive policy measures.

FORWARD OUTLOOK (OFFSHORE)

The outlook for 2024 is for a positive year in asset class returns. There are still a number of concerns regarding global growth as well as global debt.

Election outcomes in the US and Europe will be very important for global stability as they play into geopolitics and geopolitical tension.

It is expected that the US central bank will cut interest rates in the US during the course of the year. Goldman Sachs expects the first interest rate cut to take place in March, with a total of 5 rate cuts for the year. A forecast which other asset managers feel is too optimistic.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.