2024 FOURTH QUARTER COMMENTARY

LOCAL MARKETS IN A NUTSHELL

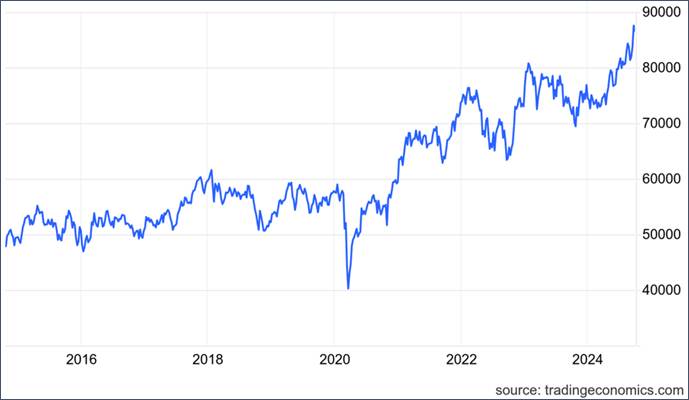

The South African stock market gained 9.61% over the third quarter of 2024. Resources fell -1.44% whilst financials recorded yet another staggering 13.46% over the quarter. Local South African centric stocks, commonly referred to as “SA Inc stocks” rose by 15.88%. The local bond market also had a positive quarter, up 9.45%

Chart: Performance of the FTSE/JSE All Share Index over the past ten years (2014/10/01 – 2024/09/30)

In the first 9 months of 2024, the local market is up 15.91% whilst the local bond market is up 14.82%. Sentiment towards local assets remains positive.

Loadshedding continues to be abated with the energy availability factor well in excess of peak demand. Although Transnet’s reform initiative is still in its early phase, the data suggests that the 2024 total SA iron ore exports will exceed that of 2023.

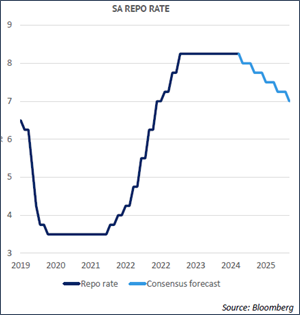

In September the South African Reserve Bank lowered interest rates by 0.25% with another cut of 0.25% expected in November. Thereafter the South African Reserve Bank’s guidance suggests another 1.25% by March 2026. This adds much needed reprieve to struggling consumers.

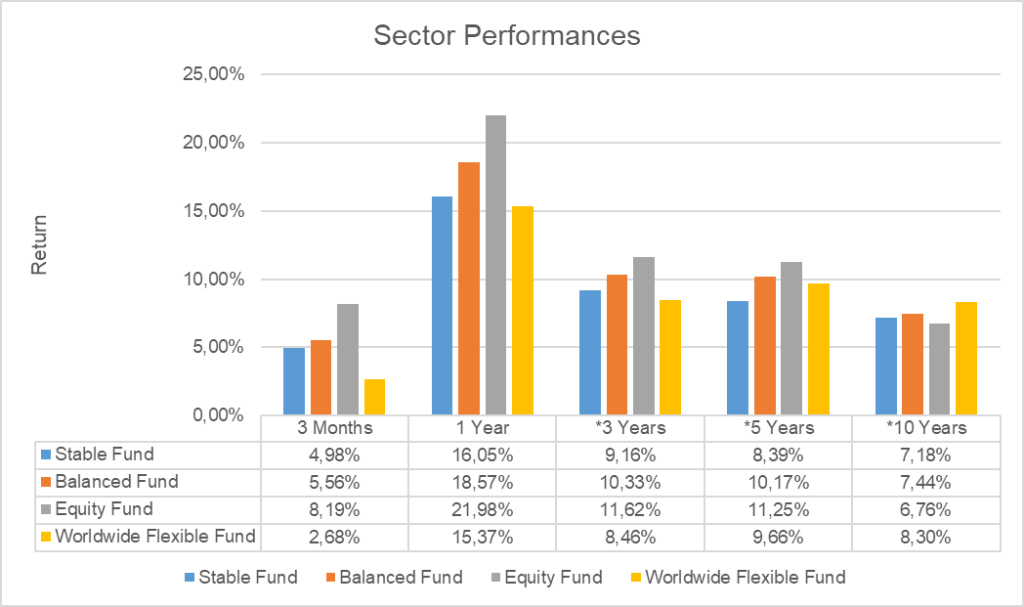

In rand terms, the average local balanced and equity fund has outperformed the average global balanced and equity fund over the last 1 and 3 years.

The rand/$ exchange rate had a very volatile quarter trading between R18.60 and R17.06 to the US dollar. That equates to a range of 8.3%. The rand started the quarter at R18.05 to the US dollar and closed out at R17.06.

On the other hand, the rand/pound was relatively stable over the quarter, trading between R22.83 and R23.75. That equates to a range of 2.7%. The rand started the quarter at R22.83 to the pound and closed out at R23.12.

Source: Profile Data 30/09/2024

* Annualised Performance

FixedDeposits and Falling Interest Rates

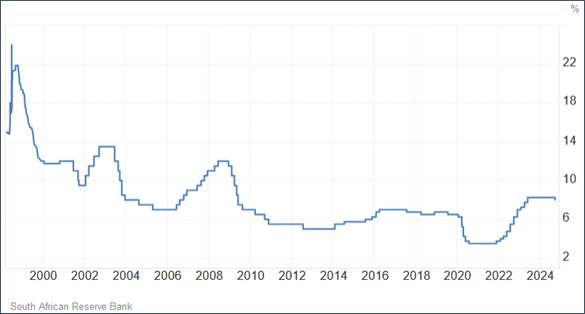

The chart below shows the long-term trend of South African Interest Rates (or Repo rate) as set by the South African Reserve Bank.

Over the last 15 years, interest rates peaked in 2023 at 8.25%. This led many South Africans to invest in fixed deposits over the past 2 years.

With South Africa cutting interest rates for the first time since 2020, consumers can take comfort in the fact that they will gradually pay less to service their debt burden. Conversely, South Africans who have fled to attractive fixed deposits over the last 2 years, can expect to see less attractive interest rates going forward.

The chart below shows the expected cuts in interest rates.

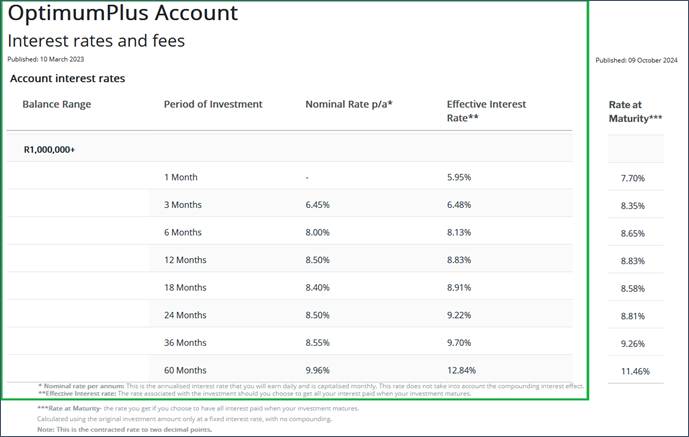

In our 2023 Second Quarter Commentary we quoted fixed deposit rates that were being marketed by Nedbank on their Optimum Plus Fixed Deposit. In the snapshot below we have compared the rates that were on offer in March 2023 compared to October 2024, after the first rate cut of only 0.25%.

Note that the “Effective Interest Rate” and “Rate at Maturity” are the same thing.

Despite only a 0.25% cut in interest rates, the 60 month deposit rate for R1,000,000 has fallen from 12.84% in March 2023 to 11.46% in October 2024. This is due to the expectation of further rate cuts.

Note that the “Effective Interest Rate” and “Rate at Maturity” figures that are quoted above, are based on simple interest where all the interest is paid at maturity. It is not the compound annual rate of interest.

If one was to convert the figures to a compound annual rate of interest, in March 2023 one would have received 10.43% compared to the October 2024 rate of 9.49%.

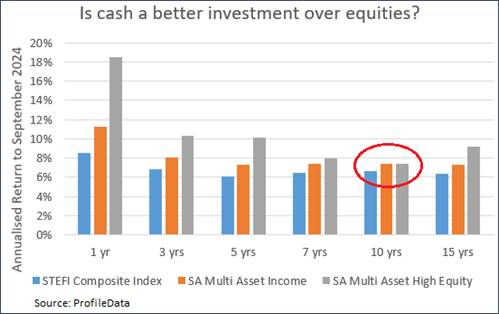

The chart below compares the return of a cash benchmark (STEFI Composite Index) in blue, and the SA multi asset income category in orange (which is comparable to high yielding cash) against the average balanced fund (SA Multi Asset High Equity) in grey.

With the exception of the 10 year return, investors have been rewarded for taking on more volatility in a longer term balanced fund compared to a high yielding income fund.

As interest rates fall, investors can expect to be better rewarded for using long term investments for long term money.

OUTLOOK (LOCAL)

As discussed in our last quarterly commentary, in the absence of structural reform, South Africa potentially faces more of the same – deteriorating financial and economic fundamentals.

Standard Bank CEO, Sim Tshabalala warned that the wave of euphoria following the Ramaphosa-led government of national unity (GNU) will only last if the promised reforms materialise – adding that investors are already wary, having been burned by the same song and dance in 2018.

Mary Vilakazi, CEO of First Rand Bank has described the outlook as “promising”. Busiswe Mavuso, CEO of Business leadership South Africa states that “the relationship between business and government has seen marked improvement with the GNU, and there are many productive areas of cooperation that are contributing solutions to our challenges as a country.”

We have already seen improvements in departments such as Home Affairs, Agriculture, Public Works and Infrastructure and Trade, Industry and Competition. As we continue to see structural reform implementation, we would expect continued momentum to drive growth in South Africa.

Although the GNU has been relatively stable after the first 100 days, instability is likely to be our GNU reality.

With global liquidity increasing (which is positive for markets) and given the shift in sentiment, South Africa is poised to benefit from the growing global economy.

As South Africa continues to cut interest rates, the cost of capital will reduce, potentially boosting local businesses and providing them with an incentive to deploy cash into the economy.

Although the outlook is positive with potential for increased growth as a result of policy reforms, the market is wary of Ramaphoria 2.0.

OFFSHORE MARKETS IN A NUTSHELL

Global equity markets had another positive quarter. The MSCI world equity index gained 6.46% in US dollars over the quarter. The world equity index outperformed the US market by 0.53% over the quarter. Emerging markets were up 8.88% however, China stole the show, rising 23.64%.

The graph below represents the World Equity Index over the last 4 years in US dollar terms.

*Performance as of 30/09/2024

In September the US central bank cut interest rates by 0.5%, thus starting their interest rate cutting cycle. Fears of a potential recession in the US continue to persist, leading some managers to take a decidedly cautious stance whilst the base case for other managers is for the US to avoid a recession in what’s called a “soft landing”.

China also embarked on its own shift in monetary policy through the largest stimulus package since the early stages of the covid 19 pandemic. The market reacted positively to the news with the Chinese market up 23.93% in the month of September.

Over the quarter the famous Magnificent 7 (the 7 largest stocks in the S&P 500 index) underperformed the S&P 500 index. This represents a healthier market than has been seen over the past two years, where returns have been concentrated in mostly a handful of stocks.

FORWARD OUTLOOK (OFFSHORE)

The previous outlook or guidance, pointed to the fact that historical data suggests that volatility increases in the 3-month period prior to the US election. We did indeed see a spike in volatility in July and August with a surprisingly benign September. Guidance for further volatility is prudent, particularly given the geopolitical tension that’s unfolding in the middle east which poses a very real risk to oil prices, inflation and supply chains.

The commencement of the US rate cutting cycle coupled with a gradual increase in liquidity, is positive for asset prices. However, short-term risks remain elevated. The market expects another two rate cuts in the US before the end of the year.

We continue to remind investors that according to historical data, economic and inflation trends rather than election outcomes, tend to have a stronger and more consistent relationship with market returns. Regardless of the outcome of the election, economic fundamentals and corporate earnings will influence the course and direction of markets.

Disclaimer: The value of investments can go down as well as up. Investors may not get back the value of their original investment. Past performance cannot be relied on as a guide to the future. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Investments and other services available through Asset Protection International may not be suitable for all investors. Asset Protection International does not make any warranty, expressed or implied, about the accuracy, completeness, or usefulness of any information disclosed herein. Any reliance upon any information in this document is at your sole risk. Asset Protection International and its financial advisers will not be liable to anyone for any direct, indirect, special, or other consequential damages for any use of information obtained in this document.